Crypto exchange-traded products (ETP), institutional offerings that track the price of crypto assets like Bitcoin and Ethereum, saw their volumes increase by over 2.2% this month, as per a report by CryptoCompare.

The data comes as institutional Bitcoin adoption was bolstered by last month’s $375 million BTC purchase by software firm MicroStrategy and Square’s $50 million Bitcoin bet this month.

However, Grayscale, one of the only crypto firms to cater exclusively to accredited and retail investors, saw a drop in the values of its crypto offerings, indicating not all was well in the institutional crypto space.

Bitcoin demand grows on institutional services

CryptoCompare noted the top ETP products by market cap included Grayscale’s Bitcoin trust ($5.8 billion) and Ethereum trust ($1.25 billion) products, the ETC Group’s BTCE product ($60.1 million), and Wisdom Tree’s BTCW product at $34.5 million.

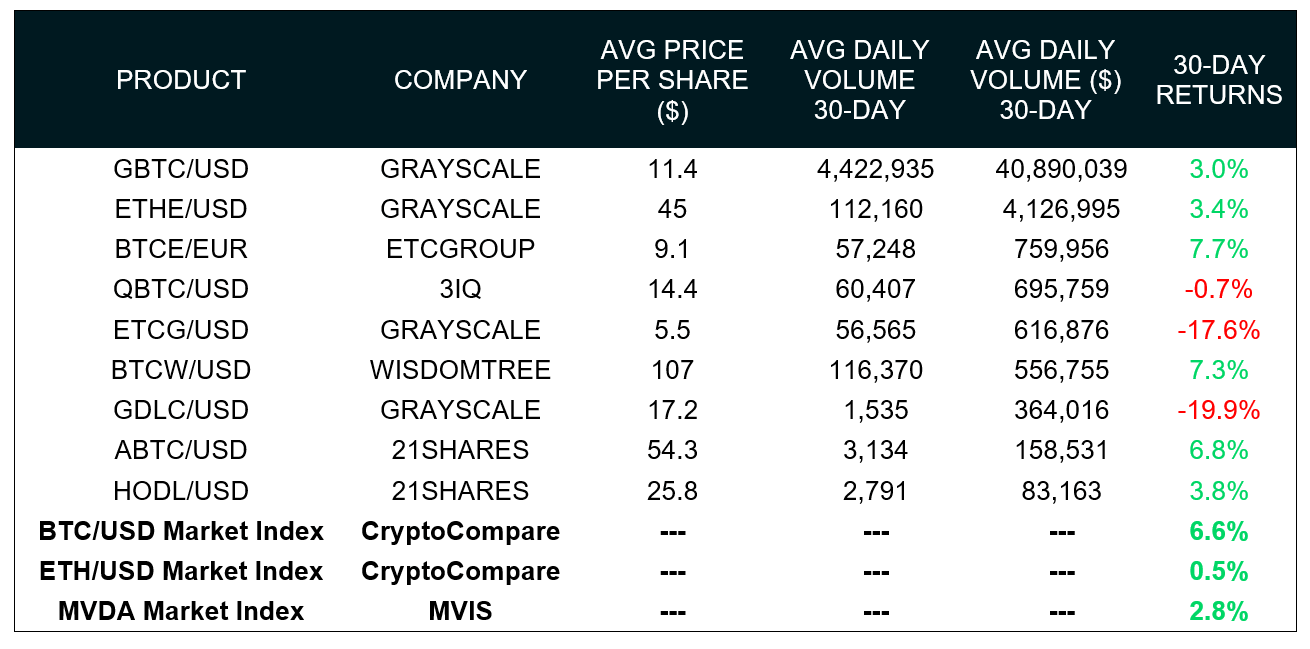

Of those, the top ETP markets by average 30-day volume were Grayscale’s GBTC/USD ($40.9 million). Demand for its Ethereum offering was next on the list with $4.13 million in daily trading volume.

The report said the ETPs with the highest returns over the last 30 days were ETC Group’s (BTCE) Bitcoin ETP at 7.7% and BTCW by WisdomTree at 7.3%. These products outperformed the spot market which experienced returns of 6.6% compared to 30 days prior, it added.

Image: CryptoCompare

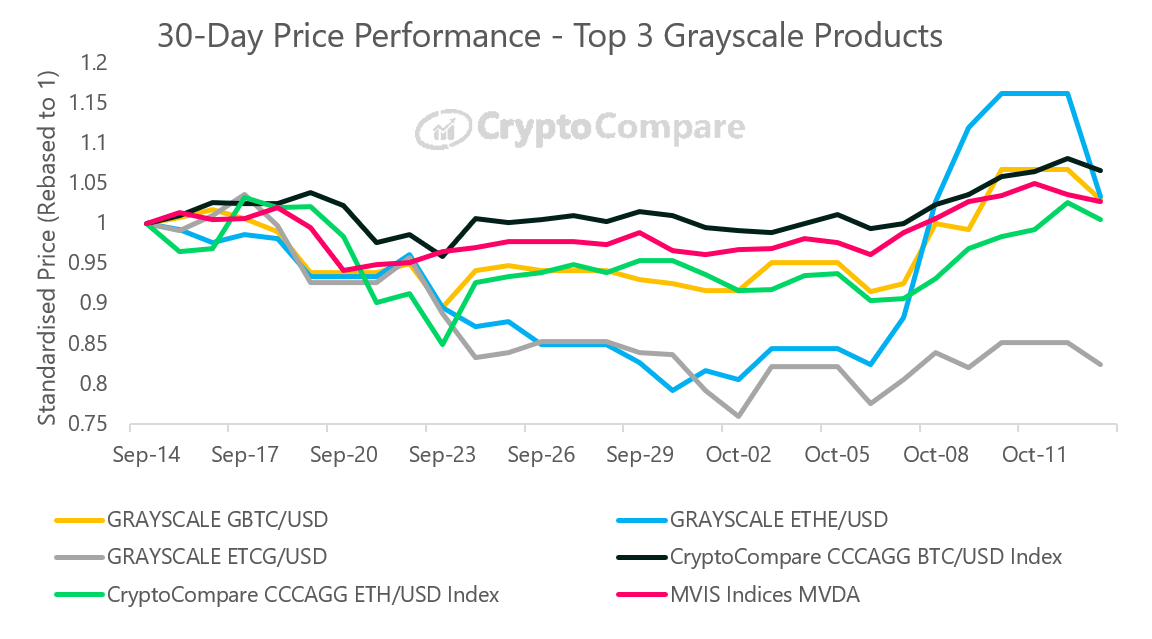

Image: CryptoCompare

Meanwhile, Grayscale’s over-the-counter offerings GDLC and ETCG experienced the largest 30-day losses in value among the top-traded ETPs at -19.9% and -17.6% respectively. “Grayscale’s products generally underperformed compared to the market,” the report said.

Grayscale sees turbulence

In terms of market cap, Grayscale’s GBTC Trust Product represented the highest market cap of all ETP products at $5.8 billion. This was followed by its Ethereum Trust Product ETHE with a market cap of $1.25 billion. The report added:

“Excluding Grayscale products, the largest ETP by market cap is now ETC Group’s BTCE product with a market cap of $60.1mn, followed by Wisdom Tree’s BTCW product at $34.5mn.”

Image: CryptoCompare

Image: CryptoCompare

Crypto ETP trading activity for non-otc products has generally declined throughout the last 30 days. The aggregate average in October has been $1.82 million per day – down 28% compared to the average in September.

Excluding OTC products, 3IQ’s QBTC product which trades on the Toronto Stock Exchange has represented the majority of the volume in October ($816k/day on average).

Meanwhile, ETCGroup’s Bitcoin ETP (BTCE) also represented a significant proportion of the volume ($599k/day on average in Oct), trading on Deutsche Boerse XETRA, the report concluded.

The post Bitcoin ETP volumes grew in October amidst institutional demand appeared first on CryptoSlate.