OKEx has come a long way. From claims about fake trading volume to initiating socialized losses, it hasn’t always been an easy ride. Yet the young company’s slogan “it’s OK to be bold” forms its very ethos. Bold, indeed, it has been. And it’s gone on to become one of the world’s largest cryptocurrency spot and derivatives exchanges.

2020: The year of crypto derivatives

At the start of 2020, the cryptocurrency space looked unstoppable. Bitcoin was posting 35 percent YTD gains, altcoins were catching up and even exceeding, and the derivatives space was on a tear. Then it happened. The black swan event that no one foresaw in the form of a global pandemic.

As cryptocurrency prices became locked in a downward spiral, it proved that, contrary to popular opinion, the markets are far more correlated to stock markets and the global economy than we thought. As major derivatives exchanges are started getting “REKT” unable to cope with the volatility OKEx is holding its own.

On Mar. 13th, for example, Bitcoin fell by more than 44 percent within a few hours, reaching a low of $3,791.9 before rebounding sharply to around $5,000. That kind of rampant volatility wiped out many traders taking the price of BTC along with it.

When this wave of traffic flooded exchanges in such a short period of time, it highlighted the ones able to cope — the platforms with enough market depth to support the volume while protecting the interests of traders.

As market leaders, even the mighty BitMEX was forced offline for “hardware issues” (later attributed to DDoS attacks). Smaller contenders like Deribit (and even Binance) saw their insurance funds get wrecked. But OKEx weathered the storm with grace (and a minor application lag).

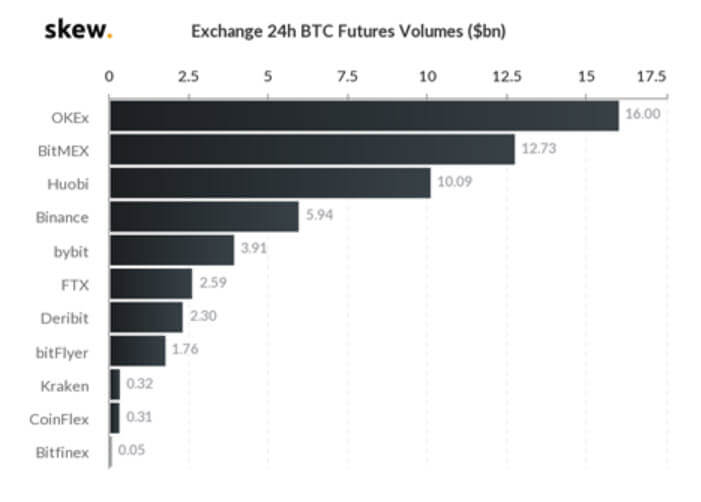

Exchange 24h BTC Futures Volumes (Source: Skew)

Exchange 24h BTC Futures Volumes (Source: Skew)

According to Skew data, OKEx hit a whopping $16 billion in 24-hour trading volume, topping the leaderboard throughout that time. According to a tweet by OKEx CEO Jay Hao, the trading platform processed approximately 300k orders/sec during the volatile period and its trading services was delivered stably.

Brief review of #OKEx performance in yesterday’s extrem market: trading service delivered stably, processed aprox 300k orders/sec.

Except for a bug caused APP lag last night for a short time. API worked fine.

OKEx team will keep optimize the product in any market condition 🙂 pic.twitter.com/gDRJ68kgqf

— Jay Hao (@JayHao8) March 13, 2020

Indeed, OKEx has come a long way.

Catching up with Financial Markets Director at OKEx Lennix Lai

Last week, CryptoSlate caught up with Lennix Lai, Financial Markets Director at OKEx, at the Crypto Compare Digital Assets Summit in London. The last time we spoke was a little over a year ago after his speech in a crowded Ball Room of the Grand Hyatt hotel in Seoul.

OKEx was hosting the event to announce the launch of its perpetual swap product — something that Lennix admits, the company wasn’t certain would be a good idea.

Related: OKEx Launches New Bitcoin Derivative: Cryptocurrency Perpetual Swaps

Related: OKEx Launches New Bitcoin Derivative: Cryptocurrency Perpetual Swaps

Some 15 months on, after its raging success (the USDT swap + token swap now trades around $300 billion) the exchange is certainly glad it did. Lai admitted:

“We had an internal debate over whether we would canalize the futures products that we already had,” Lennix says, but “it’s turned out so great. Even if the two products look the same, similar, they are actually complementary… the futures space needs both.”

I bring up the fact that many people at the conference are labeling 2020 the “Year of crypto derivatives.” And in fact, the market is already a lot larger than spot markets. But, how big is it going to go? Lennix says that at the time OKEx launched its perpetual swap contract, its derivatives market was about the same size as spot, but now, it’s two or three times bigger.

“I won’t be surprised if the derivatives space will be five or 10 times bigger than spot markets in less than two or three years,” he states unequivocally. “The movement is getting bigger, there are more sophisticated traders who understand about derivatives, they want to hedge price and execute difficult strategies… and also the exchanges have improved a lot in managing the risk on derivatives.”

(Indeed, they have, the ‘clawback’ seems like a distant memory compared to OKEx maturity now).

The space needs greater education to really grow

OKEx is one of the few (if not, the only) exchanges to make its derivatives traders take questionnaires before they are allowed to trade. The exchange wants to ensure that its traders understand what they are trading and what risks are involved. Lai said:

“We ban customers if they don’t understand the product if they fail the test. The products that we define as derivatives, options, futures, swap, you need to understand what is options, what is futures, how we calculate the margin, PnL, liquidation… then you can access the products.”

I point out that this may send a lot of users elsewhere, yet it is a tradeoff OKEx is happy to make. Lai nods his head and emphasizes:

“We even want to have more education especially on sophisticated products like options, through more investor education… I think it’s part of the adoption, you have to understand what you’re buying, what you’re trading.”

Many traders say that you don’t need to know anything about the underlying asset to trade it — just know how to follow the price. But Lennix disagrees:

“If you really want to become a serious trader, you really need to understand what’s the underlying risk, what’s the black swan risk, what you’re actually buying and selling, what event may occur… you need to be really aware before you tap into this market.”

I ask if that’s perhaps one of the (many) barriers keeping the institutions at the gate. Lennix says:

“I think so because most of the very serious institutional players have to run through very strict due diligence to allow investment managers to buy or sell and trade. They need to understand all the technical delicacy of Bitcoin and blockchain to understand.”

Regulation is also a key factor in adoption

Lai believes that regulation is also another barrier to the institutions. But, he says, it’s getting better. Unlike Binance or other Seychelles and BVI-registered exchanges, OKEx is actually registered in Malta. The company has been working closely with the Maltese regulators to comply with the European AML5 regulations. Lai says:

“Regulators across the board generally endorse bitcoin, institutions will get in when regulation is clear, and the market is going to be bigger because of this.”

Currently, Lai estimates that just one percent of OKEx’s customer base is institutional. However, that one percent easily makes up for some 80 percent of the trading volume. This, he believes, is the same for all cryptocurrency exchanges across the board.

That has to leave you wondering just how much growth there is left in the space once the institutions really enter en masse.

The year of crypto derivatives? Well, so far, it’s been the year of the “coronavirus.” However, since derivatives let traders (with iron-cast stomachs) make profits even from the most bearish of markets, the latest carnage should only fuel its growth.

The post Crypto derivatives will be ‘five to 10 times larger’ than spot says OKEx exec appeared first on CryptoSlate.