Decentralization has been the key differentiator between the world of cryptocurrencies and that of traditional finance. However, over the past decade, as cryptocurrencies like Bitcoin grew in popularity and more products were introduced, crypto-exchanges were the ones to cement their position as the industry’s most dominant entities. Interestingly, with the monumental growth of the DeFi ecosystem, there seems to be renewed interest in Decentralized Exchanges.

Speaking on the latest episode of the Unchained podcast, Haseeb Qureshi, Managing Partner at Dragonfly Capital, highlighted the growth of DEXes in the DeFi industry and how these exchanges are well-suited to take over the market and attract more users away from centralized exchanges.

Drawing parallels with the crypto-exchange behemoth, Binance, and its role in the 2017 crypto-frenzy, Qureshi noted that DeFi is now becoming a platform on which many new assets can be listed, adding that during crypto’s early years, the fact that Binance was the first to list many new assets contributed to the exchange’s success.

Source: Uniswap.info

This popularity is evident when these DEXes’ recent volumes are observed. Since the latter half of August, there has been a spike in volume on Uniswap, a figure which surged to close to over $900 million yesterday. In fact, it was even way ahead of Coinbase, in terms of sheer volume.

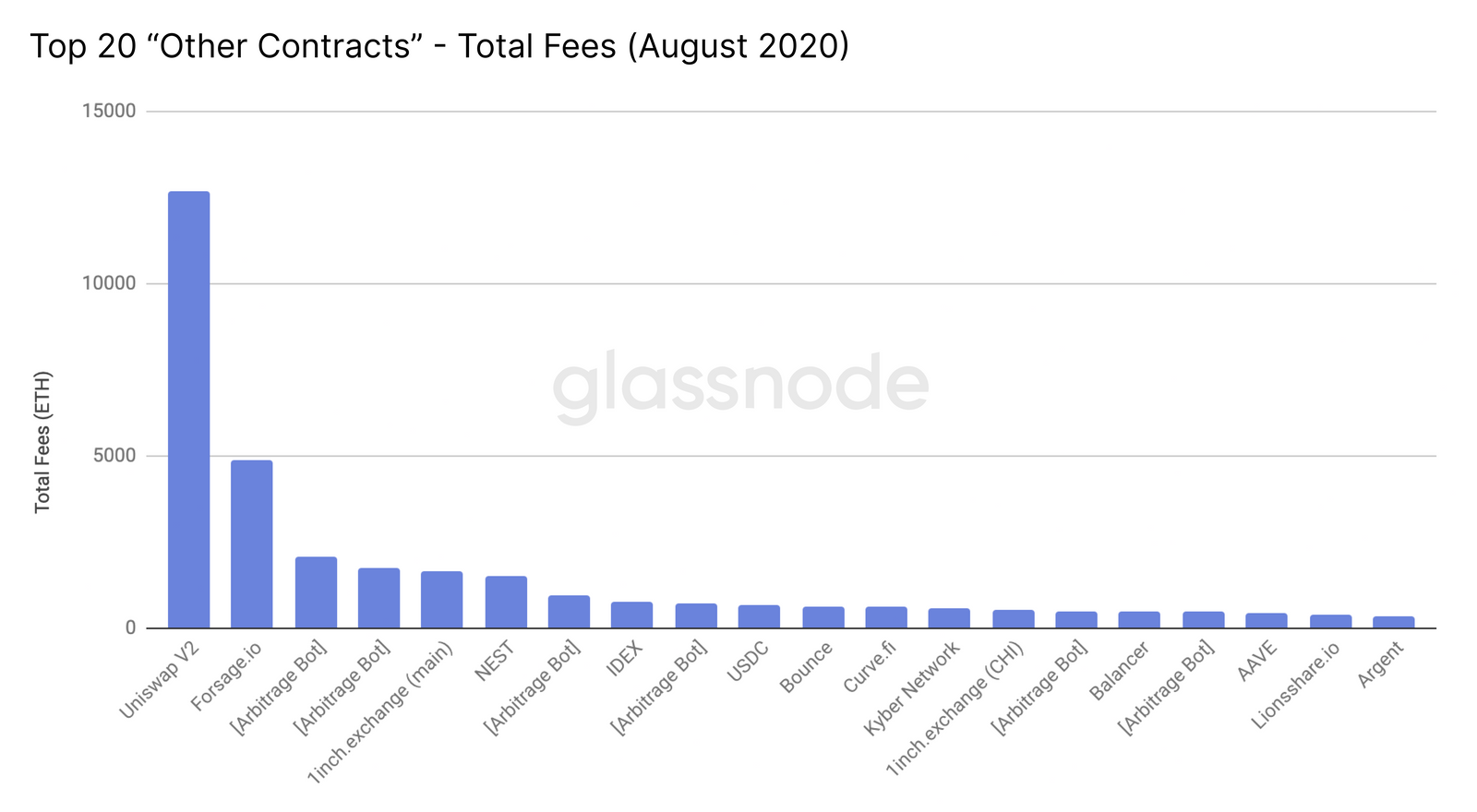

Interestingly, data from Glassnode also suggests that platforms like Uniswap have played a vital role in the Ethereum gas price surge, with Uniswap being the reason for 39% of fees spent by the top 20 contracts, along with several other DEX contracts also in the top 20.

Source: Glassnode

Qureshi went on to state that tokens are likely to first start trading on Ethereum before they are introduced on centralized exchanges as the popularity and demand for DEXes increase. This could also lead to centralized exchanges integrating DeFi on to their platforms. He concluded,

“DEXes will eat more and more of centralized exchange volume. And you’ll continue to see this phenomenon that a lot of tokens, especially if they’re on Ethereum are gonna start trading on Ethereum before they start trading on central exchanges, which is going to continue to drive people into the front doors.”

The post DeFi’s DEX foray means centralized exchanges need to act appeared first on AMBCrypto.