Bitcoin and Ethereum prices took a big hit as major Chinese banks paused all crypto-related transactions. The latest crackdown came weeks after local directives aimed at culling mining operations.

Bitcoin drop sees alts head downward

The development saw Bitcoin (BTC) and Ethereum (ETH) fall by -3% and -6% respectively, with large-cap cryptocurrencies like Binance (BNB), XRP, and Cardano (ADA) falling as much as -15%.

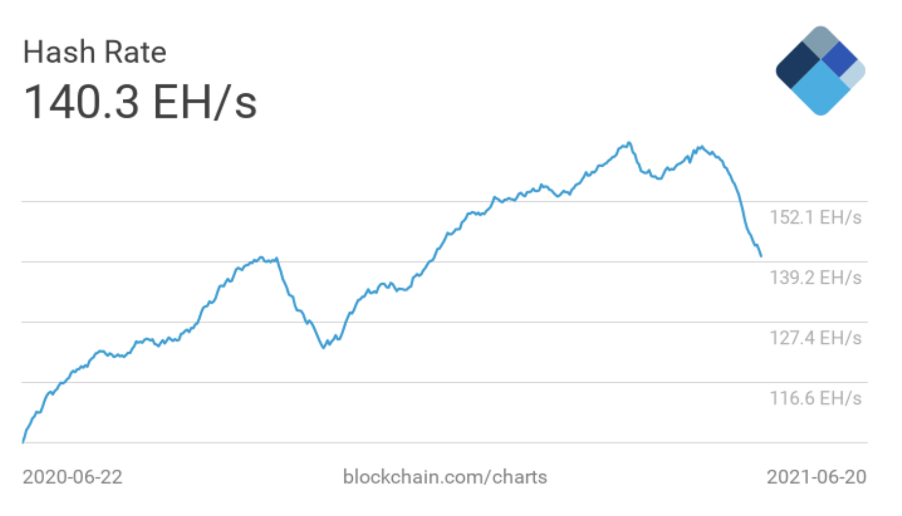

Bitcoin hashrate also continued to drop as Chinese authorities banned the operation of mining hubs in the country. ‘Hashrate’ refers to the overall computing power in the network, making it more secure and resistant to attack.

Image: Blockchain.com.

Image: Blockchain.com.

The glimmer of hope, however, came in the form of business analytics firm MicroStrategy announcing the purchase of an additional “13,005 bitcoins for ~$489 million in cash at an average price of ~$37,617 per Bitcoin.” It showed the institutional interest is still high in Bitcoin…at least for now.

MicroStrategy has purchased an additional 13,005 bitcoins for ~$489 million in cash at an average price of ~$37,617 per bitcoin. As of 6/21/21 we #hodl ~105,085 bitcoins acquired for ~$2.741 billion at an average price of ~$26,080 per bitcoin. $MSTRhttps://t.co/gLfnOxZEZc

— Michael Saylor (@michael_saylor) June 21, 2021

So what’s next for Bitcoin?

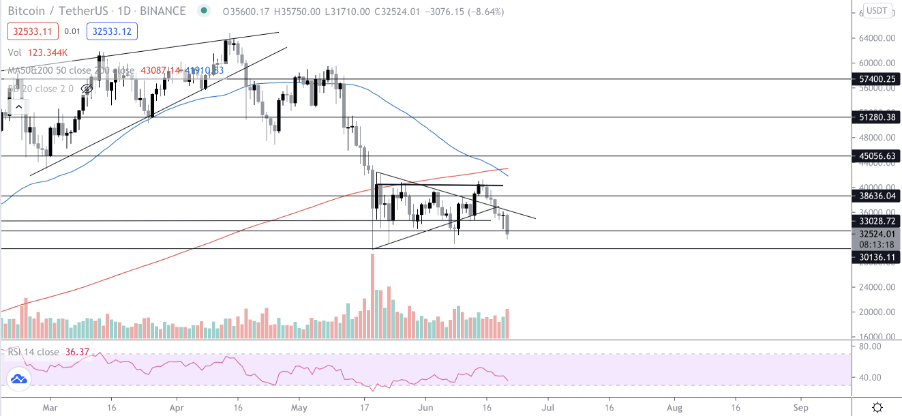

Yesterday’s candle close validated the “Death Cross”—a death cross occurs when the 50-day moving average crosses below the 200-day moving average.

This is often seen as one of the biggest trend indicators, suggesting further downside in the coming days. With negative news impacting the price and big indicators turning bearish at the same time there might be more trouble ahead for the Bitcoin price.

Image: BTC/USD via TradingView.

Image: BTC/USD via TradingView.

$33,000 is a crucial support that needs to be held. A close below that support will lead to further downside. There are no solid support levels till the $30,000 range in case the price sees more downside.

There is also a chance of seeing sub $30,000 levels in case negative news continues to impact the price.

What’s next for Ethereum?

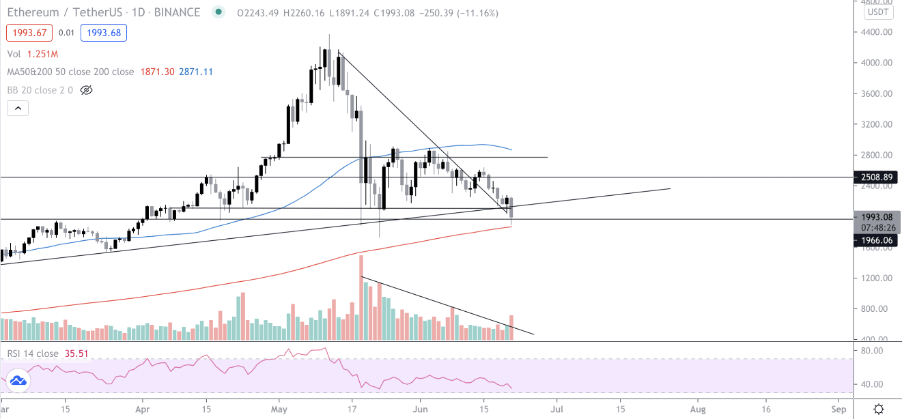

Ethereum chart continues to look bearish, it broke below the 20MA several days ago and currently is testing a big diagonal support.

Image: ETH/USD via TradingView.

Image: ETH/USD via TradingView.

The only region that might give a bounce is the 200MA. If the price manages to close above the 200MA and the $1,966 support.

The post Ethereum, BNB, XRP see big drops as Bitcoin hashrate falls. What’s next? appeared first on CryptoSlate.