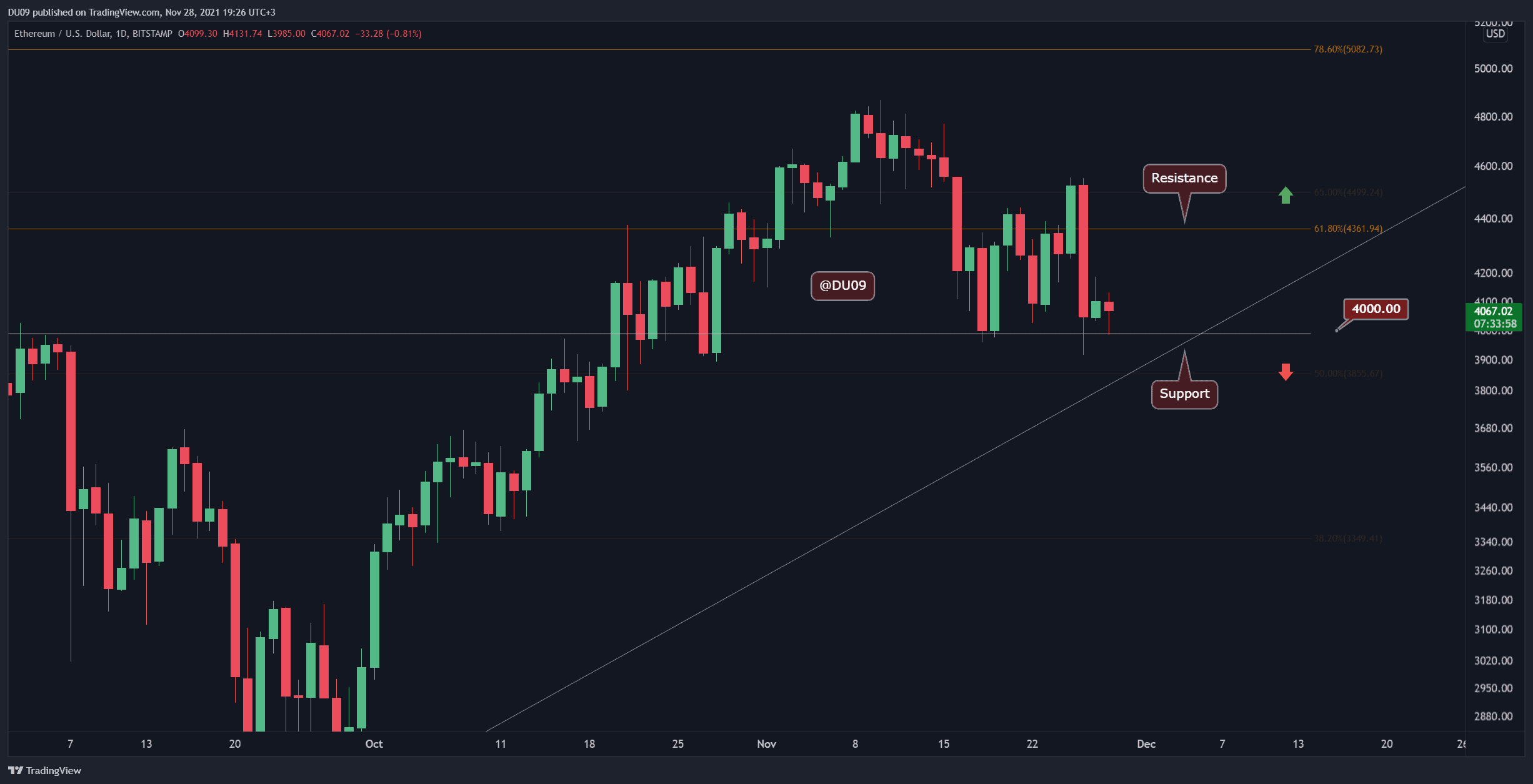

Key Support levels: $4,000

Key Resistance levels: $4,350, $4868 (ATH)

ETH failed to chart any meaningful gains throughout the week as bears intercepted all attempts at a rally and managed to bring the price back towards the $4,000 support on a few occasions.

This price action shows that bulls don’t appear ready to push above the $4,350 resistance, and bears are seemingly in control of the momentum, at least for the short term. Until $4,350 is flipped into support, bulls need to be very careful of potential downward movements.

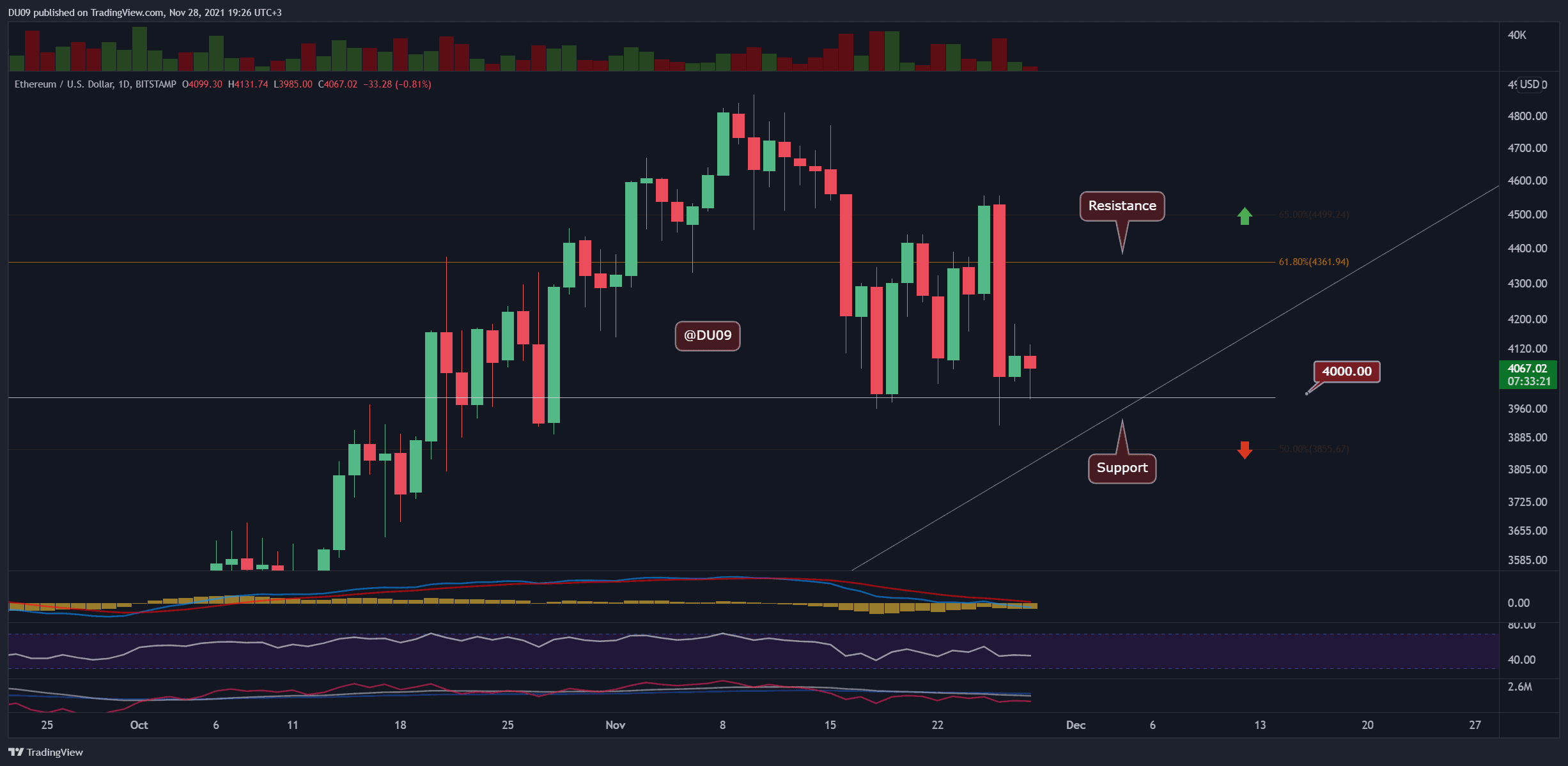

Technical Indicators

Trading Volume: The volume is decreasing, perhaps in anticipation of a major breakout. The previous attempts to break the key resistance level were on low volume, which is the reason why the bears were also successful to reject such attempts.

RSI: The daily RSI is making higher lows. This is somewhat bullish, but it is too early to get excited since the price can go either way.

MACD: The MACD is bearish on the daily timeframe, and the histogram and moving averages continue to fall. There’s o potential for a reversal in sight as of yet. On lower timeframes, the MACD is flat, suggesting a consolidation period before the next big move.

Bias

The bias for ETH is neutral. So long as the price stays above $4,000, the bulls have a good chance to regain control. If they lose this key level, then they will be at a big disadvantage.

Short-Term Price Prediction for ETH

Ethereum’s consolidation can continue, which will keep the price around $4,000. The low volume, flat trend, and the failure to move the price beyond the key resistance level show that bulls do not yet have the strength to push ETH higher. The coming weekdays may lead to increased volatility, and it’s important to remain careful.