Even counting the recent bounce, Ethereum hasn’t performed well over the past week. After peaking at $440 last week, the price of the leading cryptocurrency has slipped around 10 percent lower.

At the worst of the rally, the cryptocurrency tapped $380, but Ethereum now trades above $404 as buyers have stepped in across the crypto and legacy markets.

Chart of ETH’s price action since last week. Source: ETH/USD chart from TradingView.com

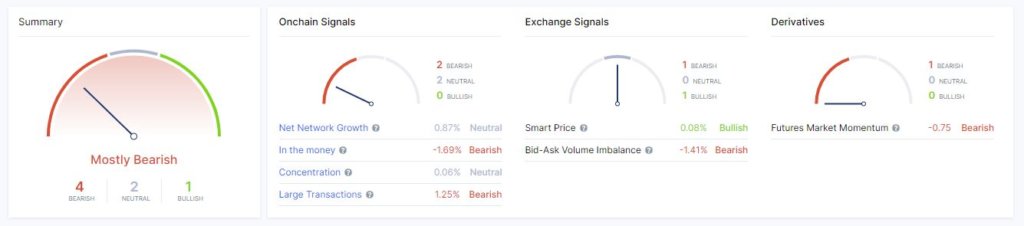

Despite the ongoing reclamation of the pivotal $400 technical level, there are on-chain and exchange indicators suggesting a bigger correction is imminent.

ETH could suffer bigger correction as on-chain and exchange signals are bearish

Blockchain analytics firm IntoTheBlock reports that as of the morning of Aug. 24, four of seven of Ethereum’s core metrics are currently printing “bearish” readings. Two of the other readings are “neutral” and the last one is “bullish.”

The four “bearish” metrics are as follows:

- In the money: a metric that tracks the momentum of the profitability of Ethereum holders.

- Large transactions: the number of transactions worth over $100,000 for a cryptocurrency over a 24-hour time span

- Bid-ask volume imbalance: the difference between the orders on the buy side of a market compared to the sell side.

- Futures market momentum: the momentum of a cryptocurrency’s futures markets as determined by other metrics like open interest and trading volume.

IntoTheBlock’s observations come shortly after another blockchain data firm, Santiment, reported that the number of daily active Ethereum addresses has been on the decline as of late despite increased transaction counts.

This lends to the theory that smaller ETH and altcoin holders are getting priced out of using Ethereum due to high transaction fees.

Fundamentals of Ethereum remain bullish

Despite this bearish outlook in the near term, analysts are certain that the longer-term fundamentals of the network remain decisively bullish.

Chris Burniske, a partner at Placeholder Capital, said earlier this year that he thinks ETH’s on-chain economies (referencing DeFi) and its position in the eyes of the public will allow it to approach a $1 trillion network valuation:

“Meanwhile, to the mainstream $ETH will be the new kid on the block — expect a frenzy to go with that realization. Given $ETH’s outperformance of $BTC over its lifetime (chart below again), not to mention smaller network value and strong on-chain economies, I see every reason for $ETHBTC to surpass ATHs.”

This has been echoed by Real Vision CEO Raoul Pal, who has commented that DeFi is likely to propel ETH higher.

In terms of tangible trends that indicate Ethereum is on the right track, more than 0.2 percent of all BTC is now represented on Ethereum, while Tether is migrating some of its service to the OMG Network, based on Ethereum.

The post Ethereum’s on-chain data suggests the worst is to come after 10% correction appeared first on CryptoSlate.