- Kevin Warsh predicts a continuation of Bitcoin’s rally due to weakening US dollar.

- Gold is losing market share to Bitcoin due to the adoption of new generations.

In an interview with CNBC, former U.S. Federal Reserve Governor Kevin Warsh validated Bitcoin‘s rise and predicted a continuation of its rally. Warsh believes that the Fed’s monetary policy to mitigate the effects of the corona crisis will continue to give momentum to the cryptocurrency.

The former governor of the FED said that keeping Bitcoin as part of an investment portfolio « makes sense » in the current economic environment. The institution has made drastic changes to its monetary policy that have favored assets that are not controlled by the Federal Reserve.

According to Warsh, the institution will continue its « aggressive » approach to fiscal policies, printing money and approving stimulus packages supported by Democrats and Republicans. The election of Joe Biden as the next president will be a catalyst for the price of Bitcoin, Warsh said:

The dollar is weakening, and after the elections overnight I’d look for the dollar to continue to weaken against a large basket of currencies.

Remarkably, Warsh made an investment in a stablecoin called Basis with billionaire Stan Druckenmiller and George Soros in 2018. The project was put on hold with less than a year. In that same year, the former governor of the Fed claimed that Bitcoin could replace gold as a reserve currency.

Bitcoin is Gold for the younger generations

Bitcoin has gone through a phase of massive adoption, supported by institutional investors in the past months. The strategy of companies such as Square and MicroStrategy is to employ BTC as a hedge against dollar inflation. In that sense, the cryptocurrency has taken a large portion of the market share from assets traditionally use as a store of value, as Warsh added:

Part of the movement in Bitcoin has taken share of gold. If Bitcoin never existed, gold would be rallying even more right now. But I guess if you’re under 40, Bitcoin is your new gold. I think of Bitcoin as a lot of things, but I think that with every day it gets new life as an alternative currency .

In a later interview for CNBC, Bitcoin bull and Galaxy Digital CEO Mike Novogratz agreed with Warsh’s statements. Although Novogratz acknowledged that there is still a correlation between Bitcoin and the traditional market, the adoption of the new generations will be the key factor as they seek « an exit from central banks ».

(…) millennials and Gen Z intuitively are buying bitcoin because they know they’re kind of screwed. The Baby Boomers have eaten all their future lunches in lots of ways by building these giant deficit.

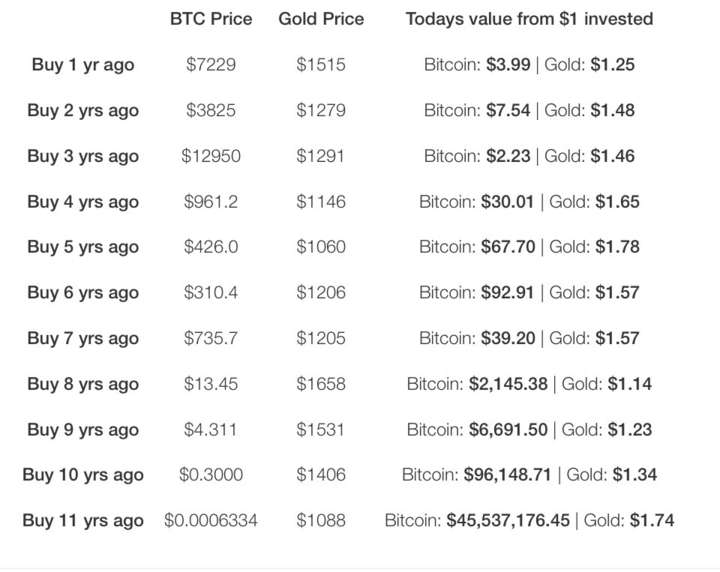

Supporting the case for Bitcoin, Willy Woo stated that a dollar invested in Bitcoin 10 years ago would be worth $96,148 today. In comparison, a dollar invested in gold would offer a much lower return of $1.34. If the former Federal Reserve governor’s prediction comes true, the next decade could be completely dominated by the cryptocurrency.

Source: https://twitter.com/woonomic/status/1344708917285117953/photo/1

Der Beitrag Former Fed governor expects Bitcoin bull run to continue erschien zuerst auf Crypto News Flash.