When Bitcoin made its dramatic decline in 2018 from all-time highs, many traders may have wished that they could profit from the thousands of dollars that were wiped off Bitcoin’s market cap and spot price.

Well, it may surprise you to learn that many traders did – and they still are in 2020. Trading a derivative of Bitcoin allows traders to profit from both positive and negative price movements in the market, but how is this possible, and how can you get started?

Find out in our how to short Bitcoin in 2020 guide, where we’re going to break down the fundamental concepts behind ‘shorting’ the market.

Shorting Bitcoin

So, you’ve decided you want to open a short position on Bitcoin. How would you do this? The first step is to identify and sign-up for a cryptocurrency derivatives platform. We’re going to review some of the best ones below.

For this, you’ll need to have some Bitcoin ready to deposit to the exchange. There’s plenty of options to buy BTC with fiat, such as USD or EUR. We review the best ways to buy Bitcoin in 2020 here, so make sure you’re ready to deposit before you start.

Once you’ve got some BTC, open a cryptocurrency derivatives exchange account and deposit your Bitcoin. Unlike traditional exchanges, most crypto derivatives exchanges don’t require KYC or identity verification, so you can start trading in minutes.

Top Exchanges for Shorting Bitcoin in 2020

As the cryptocurrency markets have matured, the number of derivatives exchanges launched to meet demand has increased, and there are now plenty of trusted options available for traders looking to short Bitcoin.

Let’s look at some of the top trading platforms:

| Rank | Exchange | Deposit Methods | Fiat Accepted | Cryptocurrency Supported | HQ |

|---|---|---|---|---|---|

| 1 | BitMEX [Full Review] | Crypto | None | BTC, ETH, LTC, BCH, EOS, XRP, ADA, TRX | Hong Kong |

| 2 | FTX (Full Review) | BTC, ETH, Stable coins | None | BTC, ETH, LTC,BCH | Hong Kong |

BitMEX

One of the longest-serving and most trusted Bitcoin trading platforms, BitMEX is a peer-to-peer trading platform for Bitcoin, Ethereum, and a handful of other cryptocurrencies.

BitMEX was established in 2014 and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its launch.

There are a number of Bitcoin options contracts available on BitMEX, which allow traders to open long or short positions.

Traders can utilize up to 100x leverage on BitMEX, which boosts your position size when opening a trade. There’s also an insurance fund that prevents traders from getting liquidated unfairly in the event of high volatility.

BitMEX’s fees are 0.075% for takers regardless of their leverage. They charge 0.01% on long funding trades, and -0.01% on short funding, with funding intervals of 8 hours. There is a 0.05% settlement fee on traditional Bitcoin futures.

Deposits on BitMEX are made in Bitcoin, which uses the ticker symbol ‘XBT’ for the purposes of BitMEX’s futures contracts.

BitMEX is one of the most well respected Bitcoin trading platforms, and we highly recommend it for opening a short position on Bitcoin. You can read our full BitMEX review here.

FTX.com

FTX.com is one of the most advanced trading platforms for shorting Bitcoin.

FTX.com is one of the most advanced trading platforms for shorting Bitcoin.

Established in 2019, FTX.com has quickly become one of the most popular crypto derivatives exchanges in the world. Built by the quantitative trading team of blockchain professional services firm Alameda Research, FTX.com has been developed from the ground-up and offers advanced trading with low fees.

Traders can use FTX.com to short Bitcoin with up to 100x leverage, with options contracts for Bitcoin and a range of other top cryptocurrencies.

Another innovative feature of FTX.com that we haven’t seen implemented on other exchange platforms is their ‘BULL & BEAR’ leveraged tokens.

These are ERC20 tokens which represent either a long or short position in an underlying asset, including Bitcoin, and it’s an incredibly quick and easy way to take a position in the market.

FTX has a tiered fee structure for traders. At tier 1, taker fees are 0.07%, and this is reduced to 0.04% at the highest tier – which can be achieved by holding FTX tokens. There are no fees on futures settlements.

Deposits on FTX.com are made in Bitcoin. Overall, FTX.com is a great option for opening Bitcoin shorts. You can read our complete guide on FTX exchange here.

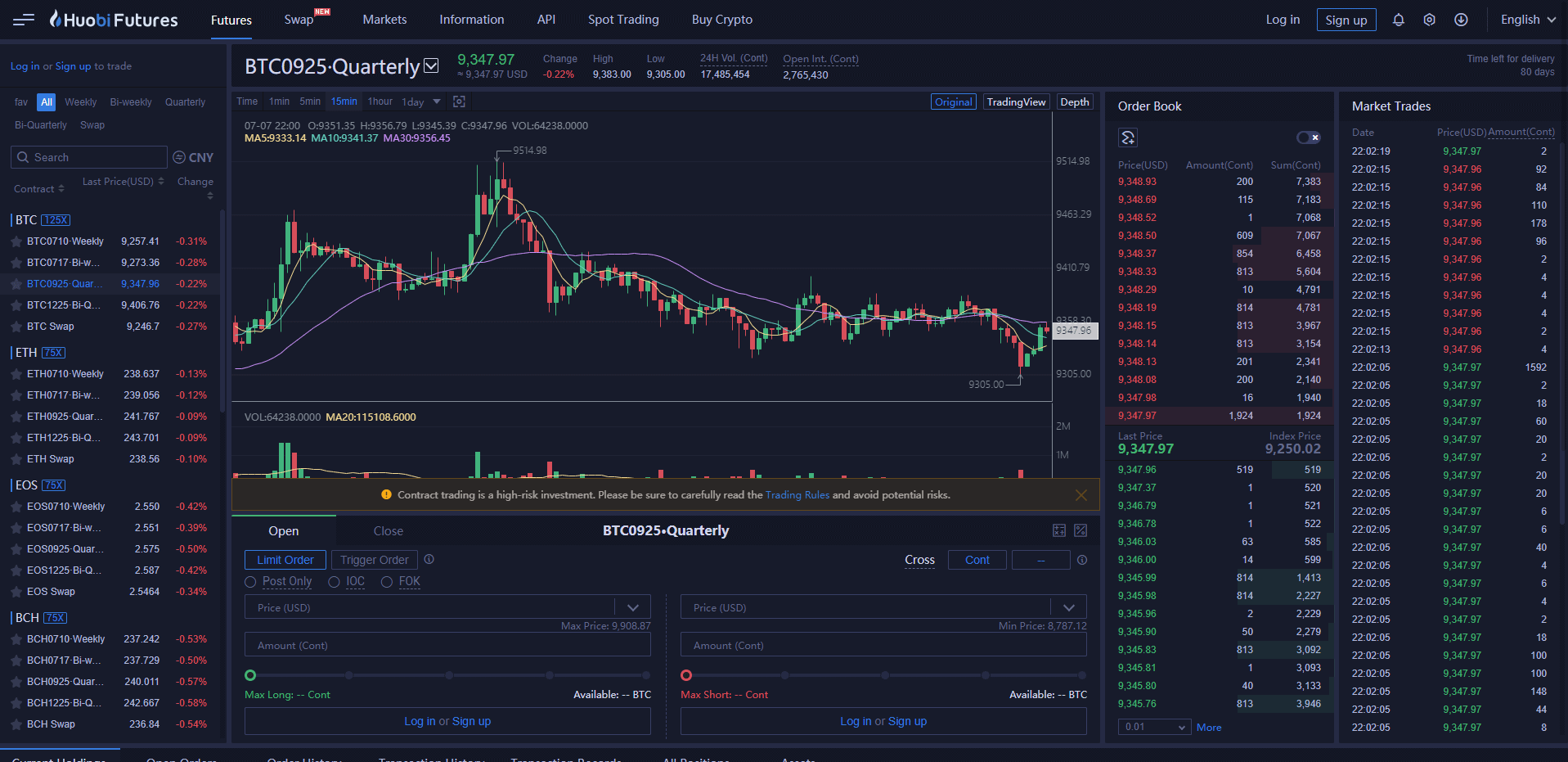

Huobi Global

Huobi Global is a trusted and long-serving exchange from Singapore.

Huobi Global is a trusted and long-serving exchange from Singapore.

Huobi Global is a Singaporean spot and derivatives exchange launched in 2013. It’s one of the highest volume exchanges in the world and has long been a favorite among East Asian cryptocurrency traders.

There are multiple derivatives and options contracts available for Bitcoin on Huobi Global, which include weekly, bi-weekly, and quarterly futures – which refers to the point at which the contract expires.

Huobi offers greater leverage than some of its competitors, with up to 125x on its bi-quarterly futures contracts, which let traders open short positions on Bitcoin.

You can deposit BTC and a range of other cryptos on Huobi for opening short positions. Huobi has an interest rate on margin of 0.098% and a 0.04% taker fee on Bitcoin futures contracts.

As one of the safest and most frequently used sites in the world, Huobi Global is a great choice for opening a Bitcoin short position. Find out more about Huobi Global in our complete guide here.

What is Shorting?

When you buy an asset or a derivative of an asset with the intention of profiting from the asset going up in price, you are said to be ‘going long’. On the other hand, a trade placed with a view to profit from an asset’s decline in price is called ‘going short’ or ‘shorting’ the market.

While it’s typical to buy an asset at spot price and physically hold it to open a long position, it’s not as simple to open a short. This is because you’ll need to sell Bitcoin in order to repurchase it at a lower price. For this, you’ll need to use a Bitcoin derivatives exchange, and trade a futures or options contract.

Some of the options for shorting Bitcoin in crypto trading are known as ‘naked shorts’ – meaning you don’t have to own the asset before you sell or short it. However, for most crypto derivatives exchanges, you will need to deposit some Bitcoin to the platform before you can open a short.

Short sells can often be opened with leverage, which is the act of borrowing against your original capital in order to increase your position size. This can magnify gains, but also increase losses. You can read more about that here.

We’ll explore some of the most popular crypto derivatives exchanges below, but first let’s look at some of the pros and cons of shorting Bitcoin.

Benefits of Shorting Bitcoin

There are a few benefits of shorting Bitcoin, mainly for short-term traders but long-term holders may also want to consider opening a short. These benefits include:

- More opportunities for profit – If the market turns bearish, you can open a short position to profit from the downward movement. In the short-term, this means you don’t have to be left holding a bag of BTC in a bear market.

- Portfolio diversity – If you’re bullish on the blockchain industry as a whole, but not Bitcoin, then shorting Bitcoin can be a great way to maximize profits from alt-runs while also profiting from a decline in BTC price.

- Derivatives over ownership – This can be a pro or a con depending on how you look at it. When you short Bitcoin, you’re trading a derivative. This means you don’t own the underlying asset, and so positions are sometimes easier to close or open, and you don’t have to worry about Bitcoin custody.

Bitcoin / USD derivatives illustration – Source: shutterstock.com

Bitcoin / USD derivatives illustration – Source: shutterstock.com

Negatives of Shorting Bitcoin

While shorting opens up possibilities to profit from periods of Bitcoin price decline, there are a few considerations you should know before opening a position:

-

Effect on the market – If you’re bullish on Bitcoin overall, but you want to profit from short-term bearish action, then you should consider that the number of short positions open influences the overall trading sentiment on Bitcoin as a whole.

-

Risk of liquidation – Trading platforms that allow traders to short the market also offer options for leverage. Trading with leverage allows you to borrow against your initial funds and trade with a much larger position. However, the risk for losing funds is also greatly magnified and you should keep this in mind while trading.

-

Fees – When you short, you’re essentially borrowing money from the exchange in order to place a trade. Unlike buying Bitcoin at ‘spot’ price where the asset belongs to you, when shorting you don’t own the underlying Bitcoin. As a result, you must pay fees – such as ‘overnight funding’ – on your position. This makes it unsuitable for long-term holds.

-

Volatility – Just as the market moves quickly into a bearish phase, it can move quickly back into a bullish trajectory. Only open a short if you’re sure the price of Bitcoin has a significant degree of downside potential.

Key Things to Remember When Shorting BTC

Hopefully, this guide will have helped you decide if shorting Bitcoin is right for you, and help you choose a trading platform on which to open a short.

As derivatives trading is a fairly technical process and comes with some risk, we recommend you take the time to read our in-depth guides for each exchange, linked in the descriptions above.

Likewise, if you’re a seasoned trader with plenty of short experience looking to move into the crypto markets and you need advice on the best ways to buy Bitcoin in 2020, read our complete guide here.

What are your thoughts on shorting Bitcoin? Let us know in the comments section below!

References

- Leverage – Investopedia’s guide on leverage

- Shorting Stocks – The basics of shorting stocks

- Derivatives Contracts – The Economic Times’ definition of derivatives

How to Short Bitcoin – A Simple Guide [2020] was originally found on Blokt – Privacy, Tech, Bitcoin, Blockchain & Cryptocurrency.