Ntropy, a company offering an API that enriches transaction data for financial services businesses, today announced that it raised $11 million in a Series A round led by Lakestar with participation from QED Investors and January Investors. CEO Nare Vardanyan says that the funding will be put toward growing the company’s team, specifically in the areas of market, product and engineering.

Ntropy was co-founded by Vardanyan and Ilia Zintchenko, who started working together on ideas for the service 2018 and launched it in 2020. Zintchenko previously co-founded Mindi, a workload management system for data centers, while Vardanyan was an investor at AI seed, a London-based venture firm focusing on AI and machine learning startups.

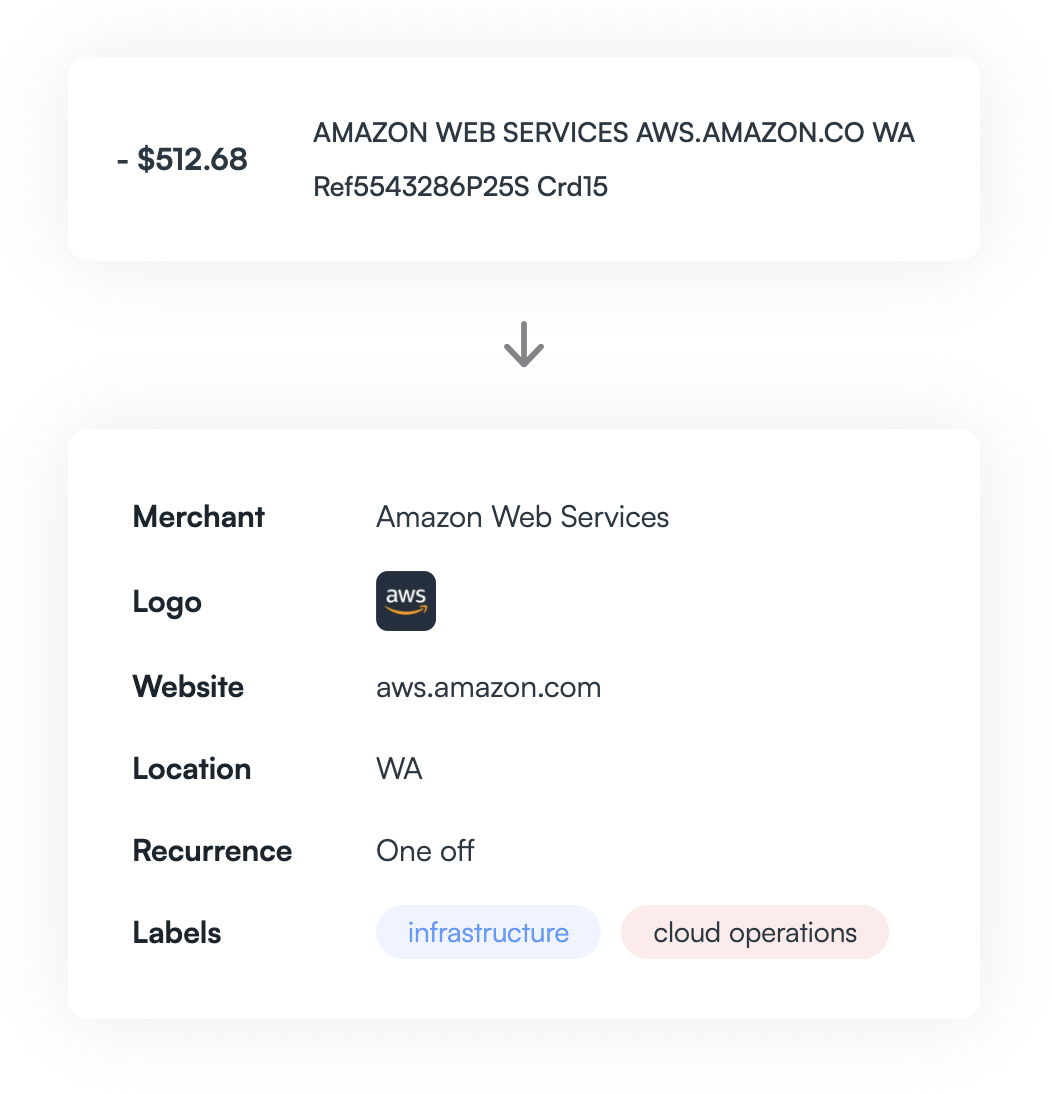

With Ntropy, Vardanyan and Zintchenko aim to cut down on the time and resources needed for fintech companies like Wayflyer, Teampay, Belvo and Monarch (all of which are Ntropy customers) to contextualize and normalize financial transactions. Normally, fintechs have to create a source of truth for transactions manually, building rules or models to classify and act on merchant, category and memo data and maintain and update those rules and models. Ntropy attempts to automate aspects of this with natural language processing technologies.

Image Credits: Ntropy

“Solving a legacy problem, such as financial transaction standardization and contextualization, we are using some of the latest machine learning techniques,” Vardanyan told TechCrunch in an email interview. “Our pipeline combines ground truth from expert humans, global merchant databases, search engines and language models trained on a condensed version of the web to process banking data across four different continents and six-plus different languages.”

Vardanyan claims that all this translates to more approvals for loans and mortgages, truly automated accounting and faster payments.

“Despite incumbents such as Visa and Mastercard and next-generation fintechs like Dave or Cashapp, processing hundreds of millions of transactions in-house is an unsolved problem,” she continued. “The intelligence layer on top of banking data is an emerging category and we are first movers.”

There don’t appear to be many competitors in the transaction enrichment space yet, although Vardanyan says that several are brewing (without naming names). Ntropy is leveraging this pole position to secure strategic partnerships, including — and notably — with Plaid as their partner for business and international transaction enrichment. (Ntropy joined Plaid’s solution partner program earlier this year.)

“We’re a company born during the pandemic, and raised our seed funding right in the midst of some of the worst markets in the last ten years until now when we closed our Series A,” Vardanyan said. “The timing has made fundraising more challenging. However, it’s also a proof point and vote of confidence for having assembled one of the strongest machine learning teams in financial services and seeing increasing amounts of organic demand from the market. The slowdown will affect our thinking around gross margins and burn rate, just like any other company, as well as decisions around prioritizing enterprise earlier in the lifecycle versus the long tail of VC-backed startups that has been a natural ramp when we just launched and works great in a booming environment.”

Ntropy has 21 employees currently and plans to hire nine by the end of the year.

Ntropy raises cash to normalize and classify transaction data by Kyle Wiggers originally published on TechCrunch