The beginning of 2021 attracted an unprecedented number of new users to crypto investing. Already in February, their number exceeded 100 million. Well, now both zoomers and boomers are on the same side here.

In May 2021, Bitcoin had erased all its price increase, followed by Tesla’s purchase of $1.5 billion in BTC. The price has dropped twice from the recent ATH of $64,824 captured in April.

Those who do not remember the events of 2018 went crazy about this price decline. But old hand crypto traders remember all the ups and downs and therefore do not panic. In fact, the crypto market decrease in May 2021 was not a surprise. There is an obvious chain of events that led to the current state of affairs.

The Crash Kickoff

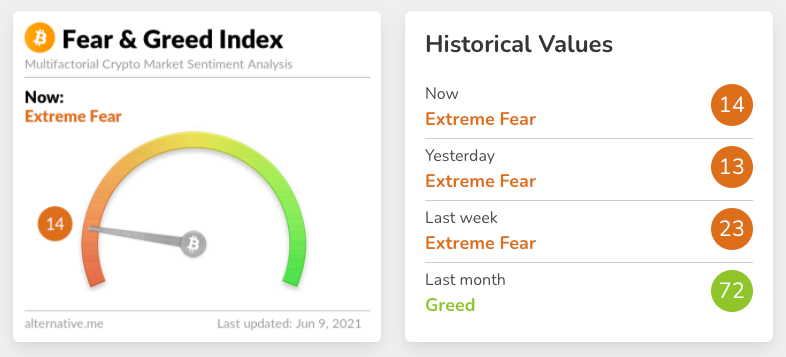

Today, one of the most significant indicators of investors’ mood is the Fear and Greed Index. By the beginning of June, it shows us extreme fear. Actually, it’s no surprise investors are scared. There is an enormous number of opinions, and a pretty significant part of them is negative.

One such fact that creates negative public perception and fear of investors is a recently released report by JPMorgan, a leader in financial services for the world’s best corporations, governments, and institutions. They claim that institutional investors can start moving away from Bitcoin back to gold. Intimidating, isn’t it?

In general, experts are convinced that Bitcoin is now experiencing an acute shortage of positive news. A growth trigger can only be a qualitative improvement in the fundamental background.

Why Did the Market Collapse?

Most of us just saw the whole market painted red. But let’s look at the reasons for this drawdown. What events led to such a substantial price drop? Spoiler alert: It’s not just about Elon Musk’s tweets, but we’ll start with this point.

Mr. Elon Musk’s Impact

Dogecoin is not the only issue that can cause price changes. On May 12, Elon Musk announced that Tesla had suspended Bitcoin as a payment method for their electric cars. Musk explained that by environmental concerns: mining processes harm the environment dramatically.

After the publication of the company’s statement, the price of Bitcoin plummeted to $45,700. So it’s the starting point for BTC drop.

On June 4, the price of Bitcoin fell by more than 5% after another tweet by Elon Musk mentioning digital gold.

Users are getting tired of such an influence. At the beginning of June, the group who identified themselves as the Anonymous group posted a video on YouTube criticizing Tesla and SpaceX founder Elon Musk for his influence on Bitcoin. The authors argue that Musk destroys the lives of ordinary people by manipulating the market through Twitter.

China Is Putting Pressure Again

One more reason for the current Bitcoin price decrease is the new wave of Chinese sanctions. Since there is a considerable part of investors in China, the news and restrictions might reduce the trading volume as well as affect the assets’ price.

So, Chinese banking and financial organizations, namely the National Internet Finance Association, China Banking Association, and Clearing Association of China, issued a warning about crypto. They announced that financial institutions should stop providing crypto transactions in China. Bitcoin reacted with a drop of 8%.

Moreover, the Chinese authorities intend to take action on mining. For the first time, high-level Chinese officials propose to ban crypto mining. One of the reasons is the high energy consumption of the industry. Mining centers in China will consume over 300 TWh by 2024. This can bring unprecedented harm to the ecological situation in the country.

Why does the news about mining in China affect the mood of the market? At least, the Bitcoin hash rate has already dropped since most of the mining pools are located and registered in China.

Immediately after this news, the OKEx stopped trading in pairs with the Chinese Yuan, and Huobi stopped providing mining services and derivatives trading for residents of China.

Tax Day in the USA

The other reason for price decline on any market, both stocks and crypto, is Tax Day. What is Tax Day about? Tax Day is the deadline for individuals to file their federal income tax returns. In other words, it’s the due date when individuals can pay taxes to get the tax return for that year period.

In 2021, the Tax Day was delayed again (as in 2020). Since COVID and restrictions associated with it overshadowed the lives of people, the IRS decided to move the Tax Day from April 15 to May 17. So, we definitely can associate declines in the markets with the delayed deadline. Investors might look for the cash to pay off capital gains tax liabilities.

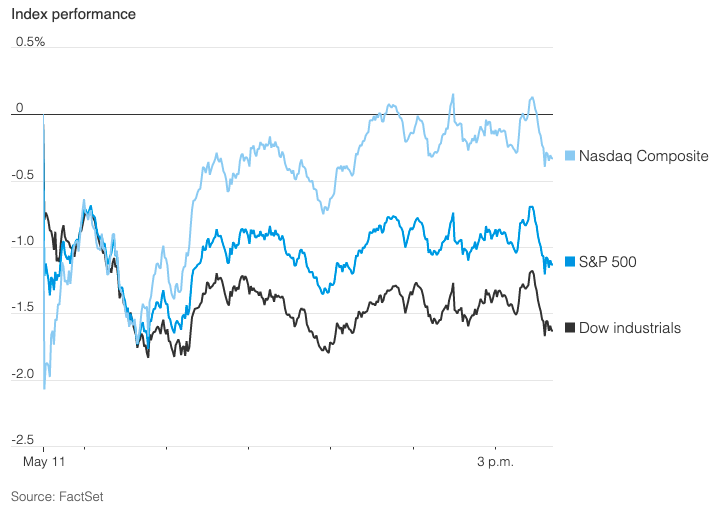

We must say that not only crypto investors felt the market crack. The stock market has also dropped by 30% from its February heights. Maybe the crypto market does not always correlate with the stock market, but there are general trends. We notice such a significant drop in crypto only because of the high volatility that is natural to this area.

Add the Joe Biden’s Increased Regulation

According to the US Treasury Department, the Joe Biden administration has proposed to enforce tax compliance. It includes a requirement to transfer information about cryptocurrency transactions in the amount of $10,000+ to the Internal Revenue Service (IRS).

According to the document, the reporting regime will be extended to foreign financial institutions, cryptocurrency exchanges, and custodians. Against the background of the current situation, this event is another link in the chain of events.

What Do Financial Ninjas Say?

First of all, we need to say the perfect saying for such a situation – many men, many minds. Some people claim Bitcoin and the crypto market to be a bubble (again), and others call this period the calm before the storm.

So, the famous American investor Bill Miller, speaking to CNBC, saw no reason to worry about the current decline in the Bitcoin price. Miller called the current decline by 50% from the historical high as insignificant. During the conversation, he recalled that the drop in March 2020 was much more significant. That was the kind of price drop that can genuinely be called historical.

If I liked something at higher prices, it is a safe bet I will like it even more at lower prices. I don’t comment on normal fluctuations in stock or asset prices.

Bill Miller

They See Me Buyin’ – They Hatin’

Many professional traders and investors see nothing crucial about the current fall in the exchange rate. We have already mentioned that all those who remember what happened in 2018 do not particularly attach significance to the ongoing changes in the charts.

As Chainalysis reported, professional investors use the crypto market crash as an opportunity to buy the dips and average their portfolio.

Felix Dian, the former Morgan Stanley trader, is in fighting spirits after the current price drop. He bought some coins when the price was $35,000.

Charles Erith, who worked in Asian emerging markets for almost a quarter of a century, claimed that the speculative vibe has already vanished from the market, so he bought some BTCs too.

At $35K, I felt it is a reasonable level at which to be added. I don’t think this is going to be a revisit of 2018.

Charles Erith

And one more opinion for you to keep calm. Kyle Davis, a co-founder of Three Arrows Capital in Singapore, reckons that such liquidation on the market is a great chance to buy.

I wouldn’t be surprised if Bitcoin and Ethereum retrace the entire drop in a week or so.

Kyle Davis

It’s All Because of Mercury Retrograde

Well, we are kidding, though. However, it’s crucial to say that things are not that bad. We hope you didn’t buy Bitcoin when its price climbed to $60K. And if you have already purchased, we advise you to read more about investments and investment portfolio creation.

What should we learn from the current fall in the price of the crypto market?

- Once again – the crypto market is EXTREMELY volatile. One day it’s up, and the next day, it’s down.

- It would be best if you didn’t buy a cryptocurrency when its price skyrockets. Indeed, this price rise will necessarily be followed by a correction.

- Such a liquidation in the market is a great chance to average the positions in your portfolio.

- World news and events affect not only cryptocurrencies but also the stock market. So watch for correlation and don’t panic.

Only the crypto community can understand all the pain we all experience from the BTC drop. Even if we feel that this is not the end of the world, we are shocked and desperate.

Share your thoughts, opinion or your story about the current market decline in the comment section below.

The post Panic on the Market: Why Bitcoin Dropped appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.