In 2016, Andrew Hoag, formerly a senior manager at Verisign and a web project lead at NASA’s Ames Research Center, founded Teampay, a platform that attempts to automate the software purchasing process for companies. Hoag’s insight was that the way businesses spend money is changing, particularly as they embraced digital transformation, and that visibility into — and control over — spend was becoming increasingly important with the economy’s ups and downs.

It seems that his thesis was correct. Today, Teampay has hundreds of customers and significant venture capital financing behind it. This morning marked the close of the company’s $47 million ($35.25 million in equity, $11.75 million in debt) Series B led by Fin Venture Capital with participation from Mastercard, Proof Ventures, Trestle and Espresso Capital, bringing Teampay’s total raised to $65 million.

Hoag says that the new cash will be put toward expanding Teampay’s partnership with Mastercard and growing its sales and marketing operations. Last year, Teampay launched a Mastercard-branded corporate card, Catalyst, with spend management features, signaling the startup’s intentions to venture further into the heated corporate card space.

“Today, companies care more than ever about where every dollar goes, which requires a new perspective,” Hoag told TechCrunch in an email interview. “In today’s economic environment, Teampay’s software-led approach has proven resilient — as we saw in late 2020 to 2021, when the economy rebounds, Teampay benefits disproportionately through accelerated growth … We increased our debt facility for additional flexibility in uncertain times.”

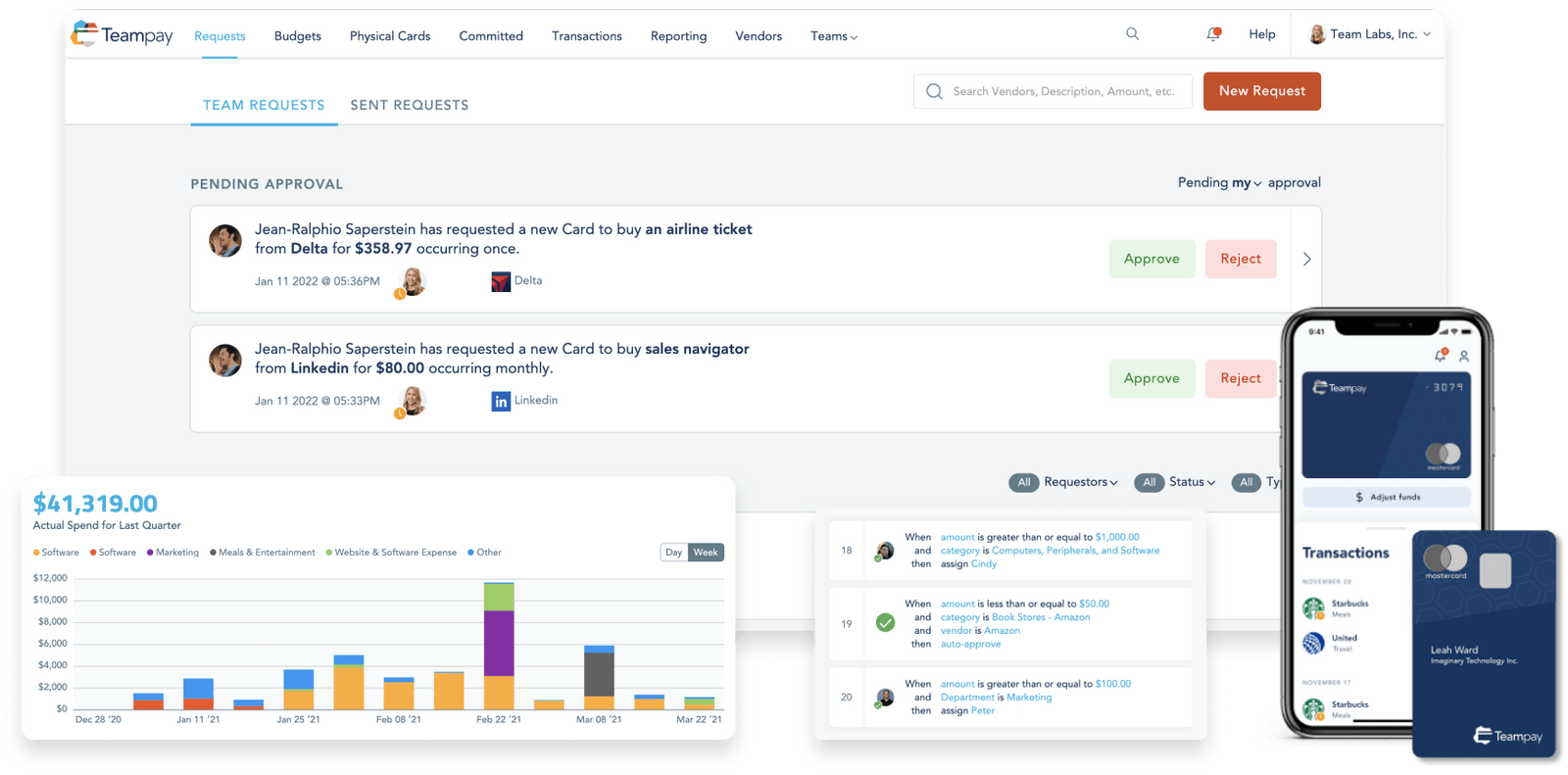

Teampay’s platform provides workflows for employees to submit and approve spending. Using it, managers can implement policies that automatically collect approvals or deny expenses that fall into certain categories. Teampay integrates with existing chat tools and delivers real-time reporting, automating invoice processing and offering virtual cards that can be limited by vendor and amount.

Image Credits: Teampay

Hoag notes that Teampay is low-code and doesn’t require custom development. “Enterprises crave control and visibility over the finances, and this not only helps the IT department, but [also] enables all departments to make better aligned business decisions,” he added.

For the past several years, venture capitalists have poured money into the corporate spend management space, lured by the promise of low-hanging fruit.

Just in January, European startup Moss, which offers corporate credit cards for small- and medium-sized companies, raised $86 million. Spendesk landed $118 million in July 2021 for its corporate spend management service. And in April, Ramp, which offers both corporate cards and spend-tracking software, secured $550 million in debt and $200 in equity at an $8.1 billion valuation.

According to Dealroom, over $2.8 billion was invested into corporate spend management companies in 2021. This year, $1.6 billion was invested between January and May alone.

Is Teampay sufficiently differentiated? Hoag believes it is, pointing to the Mastercard partnership. Teampay will collaborate with Mastercard “deeper” going forward, Hoag says, to “mutually explore opportunities” that “enhance product capabilities at scale.”

“Some teams are still stuck with a legacy, reactive mindset anchored on how businesses handled spending when purchasing was centralized,” Hoag said. “With education and innovation, we look forward to bringing best-in-class ‘consumerized’ tools to the finance department.”

The Mastercard plans might be a bit vague, and Hoag was loathe to reveal even a ballpark estimate of Teampay’s financials, including annual recurring revenue. But the total addressable market is certainly large enough to sustain more than one vendor — Grand View Research estimated its size at $15.9 billion in 2021.

In a smart analysis of the sector on Dealroom, Lorenzo Chiavarini writes that horizontal differentiation — for example, expanding to adjacent services like payment processing and targeting underserved segments — will play a key role in winning corporate expense management. Some of this sort of thing is already on Teampay’s roadmap, like growing the company’s accounts payable solution and expanding cross-border payments functionality. The challenge, though, will be maintaining momentum in the face of stiff competition like Brex, Bill.com-owned Divvy, Airbase and incumbents such as Concur and Expensify.

FinVC partner Peter Ackerson added in a statement via email: “We saw Teampay’s remarkable traction and are excited to have led this Series B round. Spend management remains an antiquated space, and we believe Teampay’s platform is ideally positioned given the long-term, strategic importance of spend management to the office of the CFO.”

Teampay, which is based in New York, has over 100 employees currently. The goal is to grow that number by 5% to 10% by the end of the year, Hoag says, barring unforeseen market turbulence.

Spend management platform Teampay expands partnership with Mastercard, raises $47M by Kyle Wiggers originally published on TechCrunch