It’s no secret that the decentralized finance (DeFi) sector has been one of the best-performing ones throughout the past several months, with many of the crypto tokens related to this fragment of the market posting intense gains.

The uptrend seen by DeFi-related tokens has slowed over the past week, as most of them have cut into their recent gains as investors take profits off the table.

Despite this, the fundamental growth seen by this sector is still trending firmly upwards, with multiple metrics hitting all-time highs over the past couple of days.

These five DeFi metrics just hit all-time highs

Although many of the crypto tokens relating to this rapidly growing ecosystem have shed some of their value throughout the past week, the ecosystem as a whole is still growing at a rapid pace.

This shows that there is a divergence between the underlying health of the decentralized finance ecosystem and the price of the digital assets related to it.

Spencer Noon, the head of DTC Capital, recently noted that there are five metrics showing the current strength of the rapidly growing sector. These include:

- $2.5 billion USD locked

- 5 million locked Ethereum

- 15,800 locked Bitcoin

- 3 million locked DAI

- $1.2 billion in outstanding debt

The growth seen on these five fronts has been particularly strong since early-June, and the launch of Compound later in the month only helped fan the flames driving this growth.

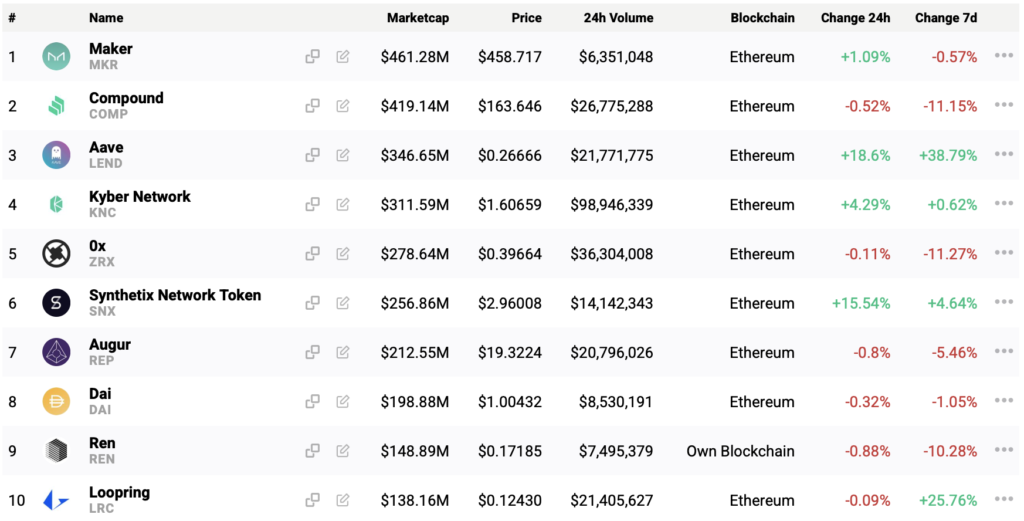

Currently, Compound, Maker, and Synthetix hold the top three spots for the protocols with the highest locked USD value.

Aave has been climbing the ranks rapidly, and now holds the fourth spot. Its growth has been primarily rooted in that seen by LEND – the token native to the platforms – which is trading up over 1,600% YTD.

DeFi-related crypto tokens still have plenty of room for growth

Despite the massive inflows of users and capital that DeFi has seen over the past couple of months, there is still plenty of room for growth.

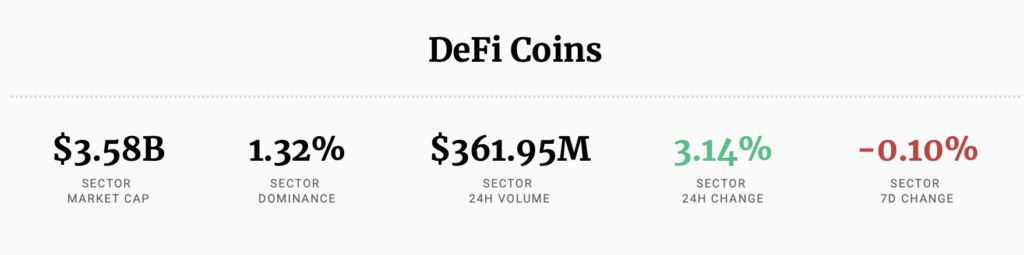

According to CryptoSlate’s proprietary data, the current market capitalization of all the DeFi tokens sits around $3.6 billion, holding 3.14 percent dominance over the aggregated crypto market.

Data Source: CryptoSlate

Data Source: CryptoSlate

That being said, its growth has slowed down throughout the past week, as many of the top crypto assets in this sector have shed ten percent or more of their value during this period.

Data Source: CryptoSlate

Data Source: CryptoSlate

This slowdown may have been induced by investors who are taking profits off the table, but it still remains unclear as to where the capital needed to sustain this growth may come from.

The post These 5 DeFi metrics just hit all-time highs; Will this crypto sector’s growth persist? appeared first on CryptoSlate.