Bitcoin is a lifeboat for escaping a broken system, but one needs to understand that system in order to see that.

In the story of Noah’s Ark in the Book of Genesis, God has come to a decision. Man had strayed far from God’s instruction, and annihilation was the chosen solution to set straight our wayward kind. Noah was known to be a virtuous man, so he and his family were chosen by God to repopulate the Earth in the days succeeding the Great Flood.

God informed Noah of his plan for the flood and instructed him to build an ark for himself, his family, and at least two of every species of animal (one male, one female, and seven pairs of all “clean” animals and birds). After 40 days and 40 nights of rain, and many days of subsequent flooding, God sent a wind over the Earth and the waters receded; Earth could be repopulated.

The Genesis Flood narrative is among the most popular stories of the Hebrew Bible and the Christian Old Testament. I’ve heard references to this story many times, but not until recently did I think much of it outside of the context of the story itself. The task in front of Noah was immense. He would have to drop everything and take to building this monstrous vessel, or face certain ruin. However, he did not languish. He got to building.

Whether you interpret this Old Testament account literally or figuratively, there is a lesson here that can be applied to many aspects of our lives: “When the flood comes, ensure that your ark is built.” Expecting a payoff in the future without work, preparation, and forethought is nothing short of foolish.

If fiat is the modern-day Great Flood, then bitcoin is its modern-day ark.

A Modern-Day Flood

“[. . .] on that day all the springs of the great deep burst forth, and the floodgates of the heavens were opened. And rain fell on the earth forty days and forty nights.”

— Genesis 7:11

The Great Flood and the ark analogy can be used in reference to many situations throughout history, but there is a present-day example right in front of our eyes. The tide has been rising for years and years, yet Cantillons continue to act in the interest of the preservation of power, in direct conflict with the good of the constituents they have sworn to protect.

Dictionary.com defines fiat as “an arbitrary decree or pronouncement, especially by a person or group of persons having absolute authority to enforce it.” This accurately describes the currencies of the world today. Governments have absolute authority over our money. Their monopoly on our money, which is a reflection of our time, endangers our freedom. Growing up, money printing never quite made sense to me. The idea that you can just snap your fingers and create a whole bunch of money just seemed wrong. Today, it still doesn’t make much sense to me, but I understand the subsequent order of effects more acutely than I did when I was a child.

Most people don’t realize why Bitcoiners have such strong disdain for fiat currencies. That’s because most people don’t realize the freedom-straining effects of these government notes. These include, but are not limited to:

- The Cantillon Effect

- Inflation (and sometimes, hyperinflation)

- Censorship

- Counterparty risk

- Coercion

- Financial irresponsibility

The Cantillon Effect

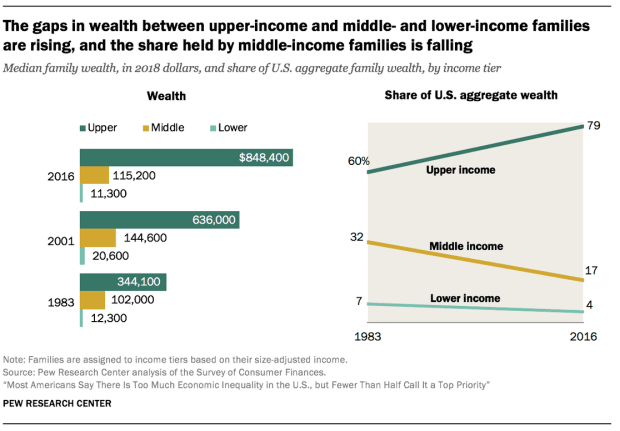

The Cantillon Effect is the phenomenon where those closest to the money printer (politicians, banks, big business) benefit greatly from an increase in the money supply, and those farthest see great harm. Such an effect breeds corruption and greed. It further concentrates wealth into the hands of the political and financial elites at the expense of the poor and the middle class.

Image Source: pewresearch.org

Image Source: pewresearch.org

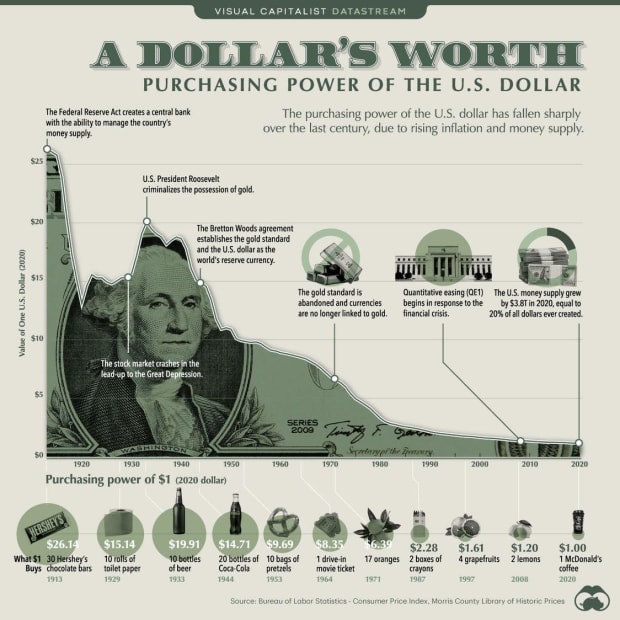

Inflation

Expanding the supply of money decreases the value of the currently-held supply. Every time the Fed prints another trillion dollars, know that your purchasing power decreases accordingly. Even if the Fed was able to maintain their 2% annual inflation target over the next 20 years (many of us seriously doubt this), that would be a greater than 40% decline in your purchasing power. Reckless monetary policy is a disregard for your hard work, time, and freedom.

Image Source: visualcapitalist.com

Image Source: visualcapitalist.com

Censorship

Money controlled by the government is destined to be censored and seized by corrupt officials. For the over 4 billion people living under authoritarianism, money is frequently embezzled, bank accounts shuttered, freedom advocates jailed — anything to keep the public in check. Censorship might be more pronounced in authoritarian states, but it is not uncommon for democracies to take similar actions against their citizens. One of the more prominent examples came in 1933, when Franklin Delano Roosevelt put Executive Order 6102 in place, outlawing gold ownership in the United States. A more recent example would be a proposal by the Biden administration requiring banks to report annual inflows and outflows of all bank accounts of $600 or more to the Internal Revenue Service. This is just another step in the direction of an overreaching surveillance state, ripe for financial censorship.

Counterparty Risk

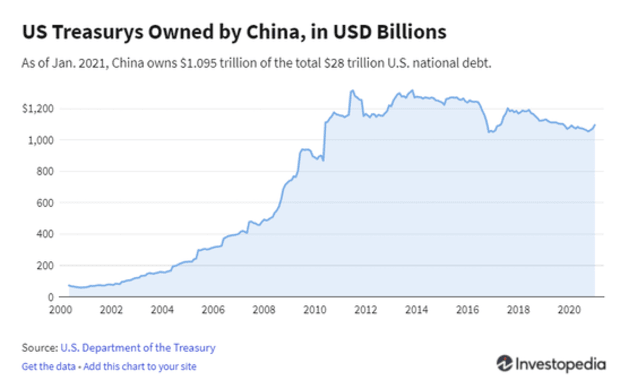

Counterparty risk is a major concern with fiat currencies, both for governments and individuals. Governments take on a massive amount of counterparty risk as they expand deficits. Constant borrowing requires reliance on other nations, as well as domestic and global institutions, to fund their expenditures. Some economists have raised concerns about the high level of U.S. foreign debt owned by China — over $1 trillion, which is more than 15% of foreign debt and 5% of total debt.

Image Source: investopedia.com

Image Source: investopedia.com

Individuals also take on a large amount of counterparty risk with fiat currencies: risk of censorship and seizure, risk of near-certain debasement, risk of fraud, risk of government defaults, and even risk of decoupling from the current currency. Alex Gladstein offers examples of the overnight debasement of the CFA Franc in “Fighting Monetary Colonialism With Open-Source Code” and currency replacement of EL Salvador’s colón in “The Village And The Strongman: The Unlikely Story Of Bitcoin And El Salvador.”

Coercion

When the government controls the money, it can coerce you into spending it (and spending it how they’d like you to). A very recent example of this was seen when U.S. politicians urged COVID-19 stimulus checks be spent as opposed to saved. Many may have planned to spend that money anyway to pay rent or put food on the table, but there’s plenty who chose to buy a new TV or pair of shoes they didn’t need because they were influenced by their government. Coercion will be an even greater problem for future fiat currencies that take the form of CBDCs (Central Bank Digital Currencies). With CBDCs, money can be pre-programmed with a spend-by date, a spend-where or spend-if criteria. In a not-so-distant, dystopian future, CBDCs could enable near-total control of domestic commerce.

Financial Irresponsibility

And with coercion and the incentive to spend comes financial irresponsibility. This may be last in the order of effects, but it is certainly not the least. In “The Bitcoin Standard,” Saifedean Ammous brilliantly details how fiat currencies force society to opt for a high time-preference. In high-time preference societies, spending is prefered to saving. The future is leveraged in favor of short-term gains. In low time-preference societies, energy is put towards building a better world. A world where our children will prosper in ways we hadn’t, ways that we made possible with our investments today. When we fix the money, financial sovereignty will reign supreme and financial irresponsibility will fade to black.

“I conclude that an increase of actual money in a state always causes an increase of consumption and a routine of greater expenditures.” — Robert Cantillon

There’s a saying in the Bitcoin community: “Bitcoin fixes this.” While Bitcoin won’t magically solve all of the world’s problems, it was thoughtfully engineered to fix the ones stated above; those caused by the flood that is fiat. The Great Flood is a great analogy for the order of effects put in motion as a result of government-controlled money. Isolating any one of these negative consequences is bad enough, but they compound. They engulf everything in their path, drowning out freedom along the way. Fortunately, Noah taught us a great lesson: When the flood is coming, all aboard the ark.

A Modern-Day Ark

Noah’s Ark was built roughly 25 centuries ago. It was made of wood from cypress and said to be nearly as large as The Titanic.

Bitcoin as the modern-day ark was built in 2008. It has a block size of 1MB and the architect remains unknown.

“Now the springs of the deep and the floodgates of the heavens had been closed, and the rain had stopped falling from the sky.”

— Genesis 8:2

Bitcoin’s engineering directly addresses the downfalls of fiat: it is resistant to censorship and coercion, it minimizes counterparty risk, it has a fixed supply that is enforced by consensus rules, not rulers, and it will end up being the greatest tool for financial freedom and financial responsibility mankind has ever known.

People often ask why bitcoin is better money than the dollar, the euro, or gold. It’s not just for the reasons listed above. It’s not just because it has superior monetary properties. Bitcoin is better money because it was designed to be so.

Bitcoin is the first-ever human-invented money. With bitcoin, we have the opportunity to address the pitfalls of previous forms of currency. With bitcoin, we have a choice. A choice to opt in to an open monetary network in favor of a closed one. A choice to opt in to a money that knows no borders. A choice to opt in to a money that we don’t need permission from rulers to use.

For those that don’t yet believe in bitcoin, the argument I’ve found most effective is focusing on the anti-fiat angle, before even getting to bitcoin. It’s much easier to look back at the inevitable than it is towards it, and how many people can argue with the inevitability that is the failure of fiat?

To that end, the pro-bitcoin argument almost has nothing to do with understanding bitcoin (at least initially). Just as Noah would not have needed the ark if it did not rain, we would not need bitcoin if our monetary policy had not been so shortsighted, our politicians so devoid of virtue, our consumption so reckless.

Once you clearly see this picture, Bitcoin no longer seems like a shot in the dark, but rather a systematic and thoroughly-devised response to monetary malfeasance. Once you understand that fiat is the flood, then you can much more easily see that bitcoin is the ark.

This is a guest post by Nick Fonesca. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.