Grayscale Trust, the institutional vehicle for accredited investors to get exposure to cryptocurrencies, has been making the rounds in crypto circles recently for seemingly cornering the Bitcoin market.

Reports confirm the entity has been buying over 70 percent of all Bitcoins produced each week, with last week’s stash alone exceeding 19,000 BTC.

This leads to many presuming the fund will eventually dump its holdings on retail investors to actualize profits. However, one prominent money manager believes the contrary is taking place; i.e. whales unloading their holdings to Grayscale.

“Very bearish”

Peter Schiff, famed economist and fund manager of global macro-biased Euro Pacific Capital, is a long-time Bitcoin critic. He has, in the past, famously stated the currency “will go to zero” and considers all crypto markets to be “worthless.”

However, the economist’s insights cannot be ignored, despite his non-adherence to the broader crypto ethos.

On Saturday, Schiff tweeted Grayscale was buying more Bitcoin than miners produce since the May 12 halving event. Despite this, falling Bitcoin prices indicate whales — or large holders — are dumping their holdings on the institutional fund.

Despite Grayscale Investment Trust buying more than 100% of all the Bitcoin “mined” since the halving, the price of #Bitcoin fell. This likely indicates Bitcoin whales unloading their coins onto GBTC speculators. Distribution from strong to weak hands is very bearish for price.

— Peter Schiff (@PeterSchiff) June 26, 2020

Grayscales provides investors exposure to Bitcoin, and other cryptocurrencies, via its GBTC and other respectively named products. As per its prospectus, one GBTC share trades at $10 on the open OTC market and holds 0.00095996 BTC per share.

Total assets under management exceed $3 billion and Grayscale charges a 2 percent investor fee.

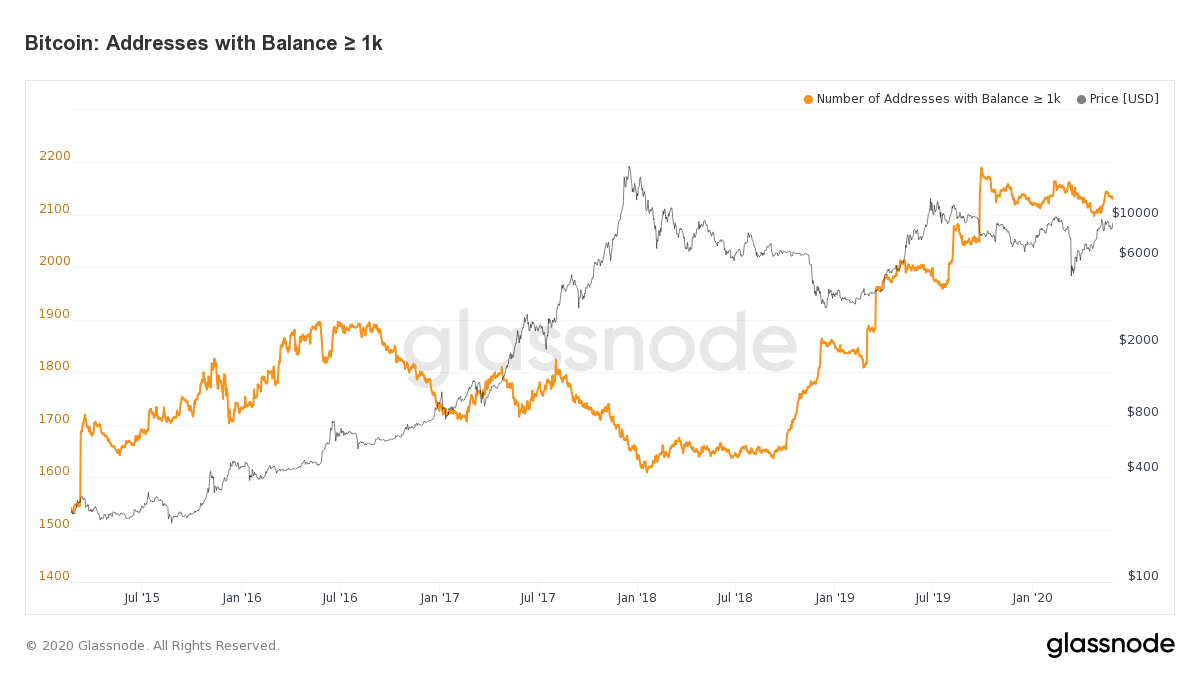

Meanwhile, data from on-chain analytics firm Glassnode shows whale holdings increasing, contrary to what Schiff said:

(Source: Glassnode)

(Source: Glassnode)

Grayscale products, not the best understood

Despite Schiff’s opinion, Grayscale’s products are not the most understood in terms of what they actually do. While they are largely defined as an ETF, Ryan Watkins, an analyst at on-chain firm Messari, says people grossly “overestimate” the amount of BTC held in the trust.

Grayscale buys way less #Bitcoin than many would think.

Factoring in “in-kind” purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.

This is just one of many misconceptions about Grayscale’s trusts.

— Ryan Watkins (@RyanWatkins_) June 11, 2020

As CryptoSlate reported earlier, Grayscale’s products disallow investors from selling until after a 6-month period. Watkins explains:

“Since no new shares are added, investors in the secondary market can push the price of the shares well above the value of the underlying cryptocurrencies.”

The above creates high-premium for Grayscale products, with the ETHE — which tracks Ether — selling at 750 percent higher than actual ETH. This creates an arbitrage opportunity.

The post Whales might be dumping Bitcoin on Grayscale, and a fund manager calls it “very bearish” appeared first on CryptoSlate.