The stock-to-flow model, which accounts for the availability and production of an asset, can help predict the future bitcoin price.

They say that the simplest way to beat the system is through emotionless investing. The irony, however, is that there is no form of investing in which emotions are not involved.

If you have been part of the Bitcoin community, then you are not unfamiliar to price predictions ranging from zero to hundreds of millions of dollars. While very few of these predictions are backed by technical analysis, most of them are just guesses driven by people’s feelings at different times.

As cryptocurrencies are becoming more mainstream with every passing day, companies as big as Tesla are jumping in on the Bitcoin train and investing billions of dollars. The bulls are running in, pouring massive amounts of capital into bitcoin. But if you want to be successful, not just in bitcoin but in any form of investment, the first rule is to zoom out.

So, what if I told you that there is an indicator that had actually predicted this bitcoin price run? As a matter of fact, that it had actually predicted the runs that have happened previously? And that it might predict one that is yet to come?

As a technical analyst, I am a firm believer that the wicks in the charts always take into account the reality that is happening on the ground. Now, obviously, no indicator can be used completely on its own to conclude an analysis. But it can always be added in your arsenal while making a final judgment.

In the case of bitcoin, that arsenal can include almost anything. Say, the Bitcoin network’s mining power or the worthlessness of our current financial system. But the indicator that I am talking about here is the stock-to-flow ratio. Now, before I go on to discuss the stock-to-flow ratio, we need to first understand the mechanism of Bitcoin mining and the mining subsidy halving.

What Is Bitcoin Mining?

The process of Bitcoin mining is basically the journey of finding a key to a certain lock. Or, you can say, it is the process of finding a solution to a very complex mathematical problem. A problem so complex that many try and fail before someone comes up with the correct answer. In other words, it can be like finding a needle in a haystack.

Learn more about Bitcoin mining through Bitcoin Magazine’s guide here.

So, then the question arises: Why do people mine Bitcoin in the first place? The answer is actually pretty simple: for their own benefit. Every single time a miner successfully mines bitcoin or, referring to our analogy above, every time they find the solution to that complex problem, the miners get a reward. The reward is that they get to write the next block in the Bitcoin blockchain and they get rewarded with a certain number of bitcoin (known as a “subsidy”) and transaction fees.

The process of Bitcoin mining is beneficial both to the miners and the Bitcoin blockchain as a whole. They keep the Bitcoin wheel rolling.

What Is The Bitcoin Halving?

Now that we have discussed Bitcoin mining, we need to talk about one of the most phenomenal concepts in Bitcoin: the halving.

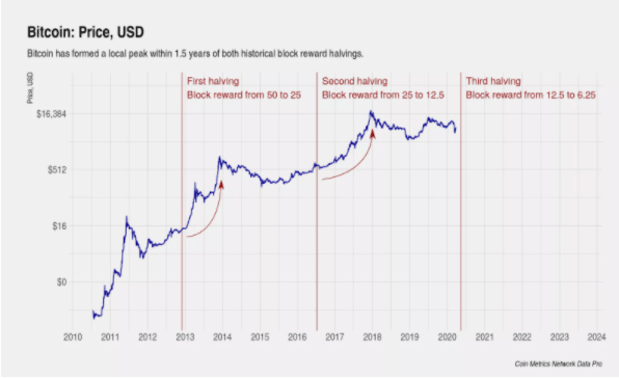

As mentioned above, the miners get rewarded every time they are successful. Today, the subsidy is 6.25 BTC. Four years ago, in 2016, the block subsidy was 12.5 BTC. And, four years before that, in 2012, it was 25 BTC, as depicted in the graph below.

About every four years, the Bitcoin block subsidy halves. And because the new supply of bitcoin created through this subsidy is continuously reducing, every halving cycle is followed by a parabolic price run. These runs are factoring the reduced supply into the bitcoin price.

What Is A Stock-To-Flow Ratio?

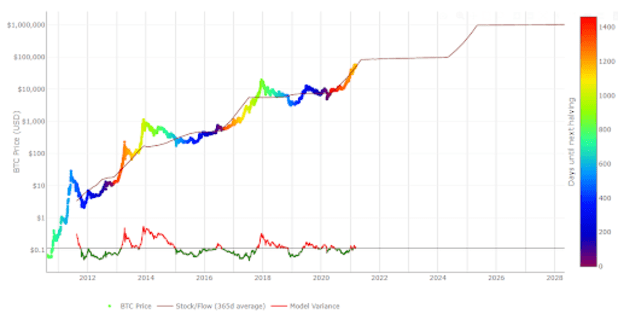

A stock-to-flow ratio is an indicator that has been used in commodities for decades. But its application to Bitcoin was famously originated by Plan B in 2019.

As the name suggests, a stock-to-flow ratio basically measures the stock of a certain resource — i.e., how much of it is available currently in circulation — against the flow of the resource — i.e., how much of it is being produced. As you can see by definition, the indicator is intrinsically based on the supply and demand mechanism. That is why the halving affects this ratio tremendously.

The relationship between a Bitcoin Halving and the stock-to-flow ratio can be seen clearly if you compare the two charts against each other. That is because every time Bitcoin Halving occurs, the flow (production) of bitcoin is reduced. As a result, the stock-to-flow ratio jumps. And, if you look at the bitcoin price, it almost follows to a tee.

What Does The Stock-To-Flow Ratio Say About Bitcoin’s Future Price

Coming back to my original point, the bitcoin price today (at the time of this writing) is around $57,000. People are giving different explanations for why. Some say a certain investor has put in a good chunk of money. Others say the price is affected by Elon Musk’s positive tweets and whatnot.

Of course, the fundamental analysis and, more importantly, bitcoin’s growing adoption play huge roles in the bitcoin price. But the bitcoin price can be predicted to some extent by the stock-to-flow ratio.

As you can see from the previous Halving cycle, the bitcoin price overshot through the stock-to-flow ratio before coming back down and averaging along the stock-to-flow ratio. Currently, the bitcoin stock-to-flow ratio indicates that bitcoin should hit a price of $100,000 by the end of 2024. Considering the historic overshoots, a conservative estimate of a bitcoin price of $150,000 at this time seems possible.

Too Long; Didn’t Read (TL;DR)

Bitcoin’s adoption is growing and reaching more mainstream investors with every passing day. And the bitcoin price has increased significantly over the last couple of months. However, there has been one indicator that best predicted this run, and that indicator is the stock-to-flow ratio.

To understand the stock-to-flow ratio, it is important to know about the concepts of Bitcoin mining and the Halving. The stock-to-flow ratio is a ratio of bitcoin in circulation to bitcoin production (facilitating through mining). Since Bitcoin production is reduced by the Halving, the stock-to-flow ratio is increased. The bitcoin price follows the ratio almost to a tee.

Historically, the price overshoots the stock-to-flow ratio before coming down and averaging out. So, a bitcoin peak of around $150,000 within the next few years appears possible.

This is a guest post by Fahim Ahmadi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.